Anti-money laundering rule change needed to help London agents

The current legislation does not allow for agents in London to carry out their daily working routine, claims Andrew Ellinas of Sandfords.

Central London based Sandfords has accused the Government and HMRC of a lack of understanding about the way in which the London housing market works and has called for a major overhaul in existing anti-money laundering legislation to help support London agents in their everyday business.

Central London based Sandfords has accused the Government and HMRC of a lack of understanding about the way in which the London housing market works and has called for a major overhaul in existing anti-money laundering legislation to help support London agents in their everyday business.

Andrew Ellinas (left), Director at Sandfords, is urging the National Association of Estate Agents (NAEA) to lobby the Government to change the rules on sub-agent due diligence, thereby making it easier for agents in London to “carry out their daily working routine”.

Andrew Ellinas (left), Director at Sandfords, is urging the National Association of Estate Agents (NAEA) to lobby the Government to change the rules on sub-agent due diligence, thereby making it easier for agents in London to “carry out their daily working routine”.

HMRC took over supervision of the estate agency business last year and has since published guidance on how to stay on the right side of money laundering regulations. But Ellinas believes that the existing rules work against agents in London and therefore need amending.

He said, “The current legislation doesn’t allow for agents in London to carry out their daily working routine and the NAEA need to speak up and apply pressure on the Government before agents are heavily penalised for simply doing their job.”

The Director of Sandfords insists that agents understand what is required of them, but says that there is an issue when it comes to sub-agent due diligence, checking vendors are who they say they are.

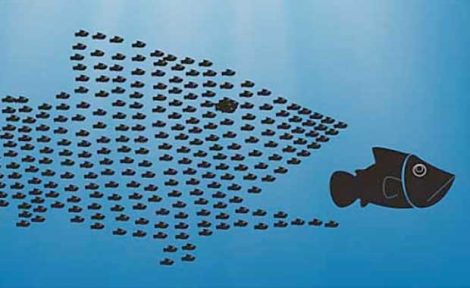

He continued, “In London we work closely with other agents. One agent might find a buyer for a property marketed by another agent. If agreed, they can sell the property for a percentage of the commission fee. As it currently stands, not only would the principal agent have to undertake due diligence against the vendor but also the sub agent, which is near on impossible.”

The current legislation states that an agent must undertake customer (vendor) due diligence when establishing a business relationship, but Ellinas wants the law changed so that information gathered by the principal agent can be passed on to the sub-agent if sold via this method of business, rather than having to do it all again.

It would appear that are many agents and property professionals support Ellinas’ views, including Vivienne Harris (right), Managing Director of north-west London-based estate agency Heathgate.

It would appear that are many agents and property professionals support Ellinas’ views, including Vivienne Harris (right), Managing Director of north-west London-based estate agency Heathgate.

“From the look of it, the Government has created poorly considered regulations, which are both onerous and unworkable for the majority of the estate agents in London and possibly the entire UK,” she said.

Harris insists that most people providing the “guidance” and changing the regulations do not comprehend what estate agents do, how they do it, or what impact these “ridiculous expectations” will have on the industry as a whole.

She continued, “Overnight half commission deals could be wiped out for both sales and lettings, as money laundering information will not only be needed for our clients and applicants, but also for a sub-agent to have on file, in relation to a main agent and the main agents client too. This material is required prior to making an appointment for an inspection. Effectively before any property viewing, a sub-agent must now have all the AML documentation on file and this information cannot be second hand, not even via a solicitor, to comply.

“The stipulation means that agents have to gain the data directly from both the main agent and the main agent’s client. It will cause havoc for all those agents who regularly share fees and work together to create business.”