MARKET FOCUS – SUPPLY AND DEMAND: Why now can be a smart time to move home

Those wanting to move home shouldn't let the current economic climate stall them. Kate Faulkner looks at why now could be a good time to buy.

– When demand is muted and supply improves, buyers gain choice and negotiating power.

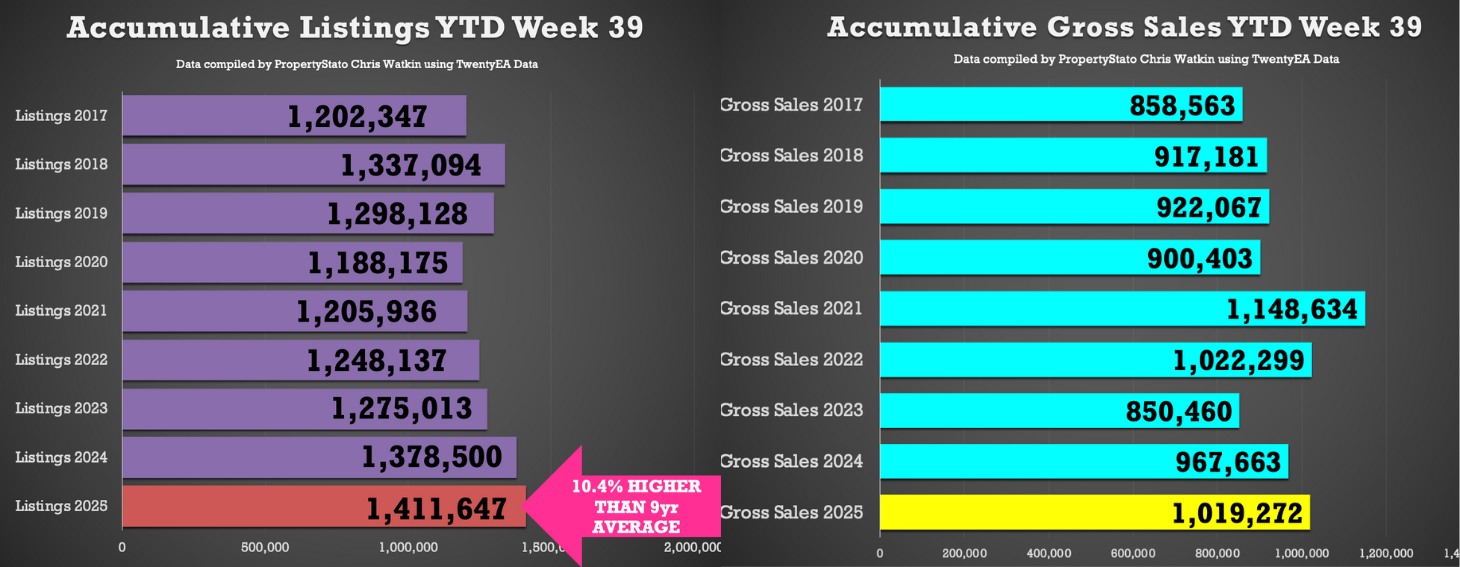

– We’re seeing more homes for sale – up by 7% according to Zoopla, so buyers have more choice.

– If buyers can find the property they genuinely want, the market is working in their favour.

London: attractive new‑build options

As an example, across London there are lots of new‑build flats – some with 900+ year leases and zero ground rent, so buyers don’t need to wait for Leasehold Reform to benefit from these changes.

Seasonal motivation for sellers

And there’s a timely incentive for sellers to accept offers – it’s nearly, dare I say it, Christmas. It may not be enough time to buy and complete, but there’s certainly time to reach exchange, which can make someone’s Christmas and encourage them to accept an offer they may not be willing to take in the New Year, or worse still make the decision to not move home and pull their property off the market.

Essentially, even if activity eases briefly, there should be enough sales in the pipeline to fund the rest of the year. Now the Budget is out of the way and hopefully we either have, or are close to, another Bank Base Rate cut, any pause in property sales is likely to reverse quite quickly either for the end of year or in the New Year.

But all of these scenarios only hold if there are no shocks to hit the economy or the property market.

Supply and demand summaries

“The month of September saw a softening of activity year-on-year compared with a strong September 2024, which was boosted by the first Bank Rate cut for four years.

“In addition, some movers started to take action to avoid April 2025’s stamp duty increase. However, the 2025 market remains resilient, though somewhat cautious, when looking at the year to date.

“The number of new buyers contacting estate agents about homes for sale, and the number of new sellers coming to market in the full month of September were both down by 5% compared to a year ago.

“However, looking at 2025 year to date, new buyer demand is up by 2% compared to the same period in 2024, while the number of new sellers coming to market is up by 5%.

“The number of sales being agreed in the year to date is also up by 5% compared to the same period in 2024.”

“HMRC monthly property transaction data show UK home sales decreased in August 2025. UK seasonally adjusted (SA) residential transactions in August 2025 totalled 93,630 – down by -1.7% from July’s figure of 95,240 (up +2.3% on a non-SA basis).

“Latest Bank of England figures show the number of mortgages approved to finance house purchases decreased in August 2025 by -0.7% to 64,680. Year-on-year the figure was -0.5% below August 2024. (Source: Bank of England, seasonally-adjusted figures).

“The RICS Residential Market Survey results for August 2025 show a continued slowdown in sales market activity. New buyer enquiries recorded a net balance of -17% (down from -7%) and agreed sales -24% (down from -17%). New instructions have fallen into negative territory for the first time since June 2024 with a net balance of -3% (+8% previously). (Source: Royal Institution of Chartered Surveyors (RICS) monthly report).”

“Supply and sale numbers continue to rise, with estate agents listing a fifth more homes for sale than two years ago.

“Supply and sale numbers continue to climb as committed homebuyers look to secure a home this autumn. The average agent has 36 homes for sale – a fifth more than in 2023 and 8% higher than this time last year.

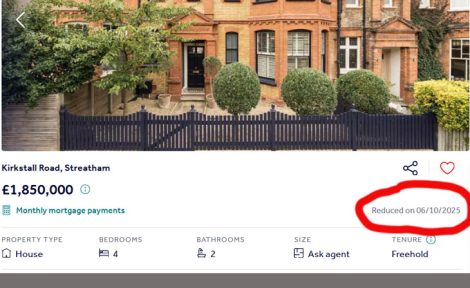

“However, speculation over potential tax changes has begun to weigh on activity in recent weeks, largely in the premium market.

“Both buyer demand and new listings priced above £500k have fallen compared to a year ago, a clear indication of movers delaying decisions ahead of the Autumn Budget.”

“Sales volume data is a lagging measure that reflects the UK residential sales transactions completed in the month.

“Provisional data for August 2025 non-seasonally adjusted sales volume shows a slight decline compared to a year earlier in August 2024 (103,610 vs 105,050).

“The average number of new prospective buyers registered per member branch fell to an average of 53 per member branch in August.

“The average number of sales agreed per member branch saw a decline in August 2025 to an average of 7.2.”