BLOG: Labour’s endless tax proposal ‘leaks’ must stop

Maskells boss says national media's habit of repeating the endless tax proposals are doing serious damage to the housing market.

Leaks from inside the Government are forcing media outlets to fill their column inches with terrifying predictions as to what the Budget might contain.

We all know that the country is broke and yet, for some reason, the basic principle of “don’t buy it if you can’t afford it” eludes even the brightest in Government. This fuels fear. The expected 4% increase in benefits fuels anger.

With every day that passes, we see new headlines, and we scratch our heads as we mentally try to re-calculate how much more this Government is going to take and what will be left for those who earned it. With no certainties, there is little investment or growth.

tested in the press

In our opinion, it would be very easy to replace the words “the job of the newspaper” with “the conduct of this Government”.

Every day we read about a newly leaked proposed tax, a new proposed law, something which is being considered and tested in the press. As a consequence, particularly in the property market, pundits start making predictions.

For the second year in a row, speculation is causing economic inactivity. The simple fact is, we don’t know what will be announced, particularly as the Chancellor seems to be tinkering at the edges rather than admitting she will need to raise the basic rate of income tax, which may solve many of her problems.

Until the Chancellor stands at the despatch box, none of us will know, and even after that, we will have to scour HMRC’s post-budget papers to understand fully.

In the meantime, whilst it is best to ignore speculation, there are a few things we can consider. I think it is unlikely that the Government will do anything which is revenue negative or neutral, as this will not appease the bond market.

Property tax has been speculated, both in the form of increased council tax, which we think is likely and, as of this morning, a tax on the sale of “mansions”. Terrifying and unclear.

What will tax achieve?

Fear aside, what will this proposed “Mansion” tax achieve? A slowdown in sales, a drop in house prices, a reduction in the value of property held as collateral against mortgages, HMRC in priority over mortgage lenders, and a slowdown in the mortgage prepayment speed, driving higher cost of borrowing in the capital markets.

Hardly revenue-generating and potentially revenue negative if the multitude of potential consequences are considered.

And if this proposed tax is in the form of a Capital Gains Tax, we assume that one could offset it against potential capital losses incurred elsewhere by an individual, possibly making the tax revenue neutral or even negative.

It may therefore be that as soon as this tax is introduced, all house sales will be via companies where capital gains can be rolled up. And as to the current gains – with indexation relief frozen in 1998 and removed in 2008 – will our grandparents pay CGT on a house they bought in 1962 for £35,000 and may now be worth £2m?

Many pensioners did not and do not receive the income they expected due to historically low interest rates and have been living off capital to make ends meet.

Headlines are likely to promote an emotional response from both the afflicted and the comfortable, and until we know, life must go on.”

Our point is this – headlines are likely to promote an emotional response from both the afflicted and the comfortable, and until we know, life must go on.

A study by Cornell University suggests that 85% of worries do not materialise, and of the 15% that do occur, 79% found that they were able to handle the situation better than they had anticipated.

From the coal face, we expected, and we are seeing, a slowdown in applicants and vendors prior to the budget. Our buyers, however, are committed, and whilst the market has fallen, deals are going through – we have one exchanging tomorrow – our 6th in the last two weeks.

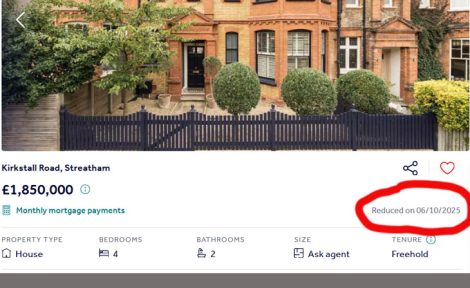

Our clients are taking advantage of the fact that the widely reported Government leaks driving these headlines provide them, as realistic buyers, the space to acquire a property at prices not seen since 2010.