house prices

-

Kate Faulkner

MARKET FOCUS – SUPPLY AND DEMAND: Why now can be a smart time to move home

Those wanting to move home shouldn't let the current economic climate stall them. Kate Faulkner looks at why now could be a good time to buy.

Read More » -

Kate Faulkner

PROPERTY MARKET UPDATE: Slow, steady and stable

Kate Faulkner reviews the latest indices, which reveals the UK property market is experiencing robust sales activity, but at a slower pace.

Read More » -

Housing Market

40% of home buyers negotiated a discount during past 12 months

Paula Higgins of the HomeOwners Alliance says her research reveals how significant number of home buyers achieved a price drop, although the same proportion paid the asking price.

Read More » -

Housing Market

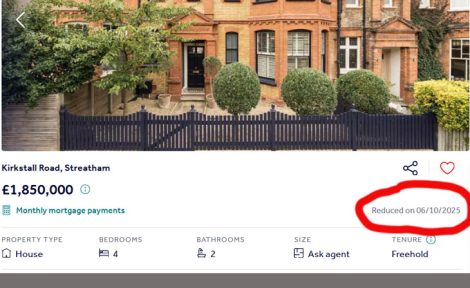

Vendors slash prices as property market stalls ahead of Budget

New figures reveal around 6% of listed properties see a price cut within 30 days, in another sign the housing market is slowing down.

Read More » -

Housing Market

Sales pipeline ‘largest for four years’, Zoopla claims

The portal says estate agents are set to receive £1 billion in commission from current sales agreed – and points to relaxed lending rules driving it.

Read More » -

Columns

TOWN AND CITY TRACKER: Manchester lows and Belfast highs

Property market expert, Kate Faulkner, reports varied house price activity from one city to the next, with few areas keeping pace with inflation.

Read More » -

Housing Market

Industry reacts to surprise jump in house prices

The latest Nationwide HPI reports a 0.5% increase in house price growth last month, which was higher than many experts expected.

Read More » -

Columns

PROPERTY MARKET UPDATE: Subdued end to 2025 expected

Kate Faulkner, property market expert, says the latest indices suggest a quiet period of activity until the end of the year.

Read More » -

Kate Faulkner

TOWN AND CITY TRACKER: House price rises ‘unusually high’

House price expert, Kate Faulkner, analyses the latest data, revealing double-digit growth in some regions according to figures from the Land Registry.

Read More » -

Kate Faulkner

HOUSE PRICES UPDATE: the forecast is bright

News from property price indices is positive, writes Kate Faulkner, and indicates we are as 'near' to normal as we have been in years.

Read More »