BLOG: ‘Flat owners waited for leasehold extension reform, but now it’s costing them £1,000s’

Leading leasehold figure reveals how Government foot-dragging is costing flat owners who gambled on reform dearly.

Many leaseholders find themselves sitting on a financial time bomb. Not because of economic turmoil or interest rates, but due to a simple decision – they waited for reform.

The promises began in 2018 by the Law Commission – a bold vision of easier, cheaper lease extensions, abolition of marriage value, and sweeping changes to the system. The messaging was clear: big changes are coming!

And so, as is evidenced by the decline in lease extension activity, many did nothing.

Fast forward to 2025. Reform has happened – well, sort of. We have the Leasehold and Freehold Reform Act 2024 (LAFRA), which was rushed through in the final hours of the last government.

But it hasn’t settled the key valuation questions, such as how a ground rent is to be capitalised or what deferment rate applies to a landlord’s reversion.

Meanwhile, the cost of delay for flat owners has quietly mushroomed.

Cost increases

Lease extension premiums increase by 5% each year, which is compounded. And that’s even before marriage value applies.

A flat with 86 years left in 2018 will now have 79 years. This is a dangerous threshold for flat owners who decided to wait because once a lease falls below 80 years, the calculation changes: marriage value kicks in, immediately adding around 4% of the flat’s value to the premium.

And each year thereafter, the proportion of marriage value grows as the lease term reduces – and that’s in addition to the 5% compound annual increase.

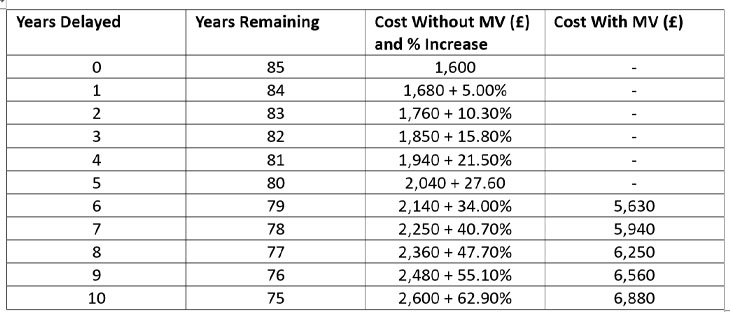

This is not just academic, it is playing out in real life. The table is prepared by myleasehold. Based on statutory valuation methodology, per £100,000 of long lease value, it shows the rise in premium.

Reform illusion

There is a bigger issue here: belief in reform as a guaranteed win. Many leaseholders thought government intervention would produce savings. In truth, the reforms – even if fully enacted – were never going to retroactively rescue those who waited too long.

Even if the abolition of marriage value survives the legal challenge, the new regime is not yet active, and we still have the definition of ‘non-onerous ground rent’ still up for debate.

So we are in limbo, and the market doesn’t like that. Buyers apply appropriate discounts to leases under 85 years even up to 90 years. Whilst for leases below 80 years, what is it going to cost to extend (including fees) and what is lost in terms of long lease value?

The value of the property will be impacted by the buyer’s liability to extend, with all the cost and hassle that comes with it. The buyer is taking on the headache – and that comes at a price.

Real cost

And this is where it is not just about lease extension premiums. It’s also that delay can reduce flexibility.

Flat owners lose leverage in sales negotiations, and based on where we stand today, some flat owners risk being trapped in a game of policy roulette, hoping that the next announcement will magically save them money.

What should advisers say now?

If a lease is approaching 80 years, waiting is a high-risk strategy and the effect of compounding the premium over an increasing number of years increases the cost and risk.

Even for longer leases, the direction is clear – price creeps up each year, and reform is unlikely to reverse that.

Many leaseholders think they are saving money by waiting but maybe they are just compounding the cost and increasing complexity.

Case study: Flat in Fulham worth £500,000 with an 85 lease five years ago.

The lease extension premium (excluding ground rent) would cost £8,000 then; today premium costs £10,200.

This is an increase of almost 30%. The flat owner was advised to wait for reform, and the lease is now just above the critical 80-year point.

Extend today, and it just escapes the added cost of marriage value. Wait another year, and the premium leaps.

The risk? Missing the deadline and facing a £20,000 increase, overnight. And to top it off, lenders are increasingly wary of short leases, so the leaseholder is left with a less marketable and less mortgageable asset. Flat owners just don’t seem catch a break.

Author bio: Mark Wilson is the Director of Myleasehold and a member of ALEP (Association of Leasehold Enfranchisement Practitioners).