AUCTION UPDATE: 2024 ended with sales down but revenue up

The latest auction update from Essential Information Group reveals that fewer properties were sold compared to the previous year, but at stronger prices.

While the number of properties reaching the auction rostrum in December increased slightly compared to the previous year, a drop in auctions sales led to a decrease in the percentage sold, reports Essential Information Group (EIG).

While the number of properties reaching the auction rostrum in December increased slightly compared to the previous year, a drop in auctions sales led to a decrease in the percentage sold, reports Essential Information Group (EIG).

However, the total revenue raised edged higher, suggesting that properties successfully sold achieved stronger prices, highlighting a selective but competitive market.

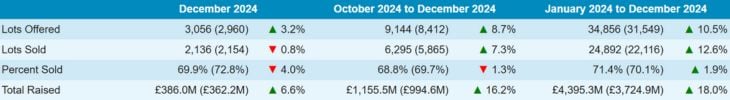

A total of 3,056 residential lots were offered, and 2,136 sold, raising £386 million, which is 6.6% increase on the same period the year before.

Despite the final month’s subdued performance, the year ended on a high, with the residential sector performing exceptionally well and showing significant increases in lots offered (10.5%), lots sold (12.6%), and total revenue raised (18%).

Despite the final month’s subdued performance, the year ended on a high, with the residential sector performing exceptionally well and showing significant increases in lots offered (10.5%), lots sold (12.6%), and total revenue raised (18%).

Regional variations

The final quarter showcased varied regional results, with every region achieving growth in at least one auction sales metric. London, the North East, and Yorkshire and the Humber solidified their positions as key auction hubs, posting improvements in total sales metrics.

Regions like East Anglia and the West Midlands recorded strong growth for lots sold and total raised, despite a dip in percentage sold compared to the previous year.

Meanwhile, impressive gains in total revenue raised despite reduction in other metrics were observed in the East Midlands and Wales, emphasising the diverse nature of regional performance.

Although revenue was down in the last three months of 2024 in Scotland, activity ramped up with a 54.7% increase in lots offered and a 12.1% rise in lots sold. Despite the small data set, Northern Ireland showed impressive growth across all residential metrics too.

Managing Director of EIG, David Sandeman (pictured) concluded: “While December marked a quieter close to 2024, the strong performance across residential and commercial sectors lays a solid foundation for potential growth in 2025, provided vendors and auctioneers continue to adapt to the market’s selective and competitive dynamics.”