Government reforms to ‘completely change’ how conveyancers work

Fees predicted to drop by 20% and transaction times cut by weeks, as mandatory upfront information reshapes legal process, but is this 'HIPs' all over again?

The Government’s home-buying reforms will fundamentally reshape conveyancing, shifting legal work to before properties are listed rather than after offers are accepted and introducing new transparency requirements for the sector, it has been revealed.

According to analysis of Ministry of Housing, Communities and Local Government documentation by Legal Futures, fees are expected to fall by more than a fifth, with average costs dropping from £1,540 to £1,200 for buyers and from £930 to £680 for sellers as streamlined processes increase competition.

Transaction times will be cut by four weeks, while fall-throughs are expected to come down from one in three to one in seven, with first-time buyers predicted to save around £710 per transaction and home movers by £400.

Before marketing

Under the new system, sellers will be required to work with conveyancers to prepare searches and property information before marketing begins, addressing what the MHCLG identifies as the core problem – lack of access to the right information at the right time.

Sellers will also be expected to commission property condition assessments before listing, with surveys likely to become mandatory as part of the upfront information requirements.

This upfront approach will eliminate delays and duplication, with digital property packs becoming standard and linked to unique property reference numbers and Land Registry records.

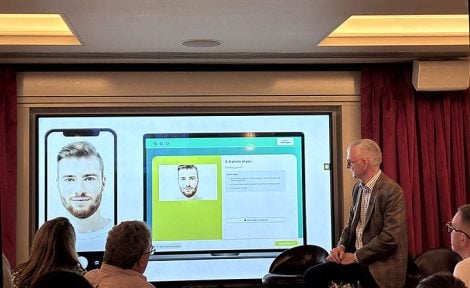

The ministry says its first step will be streamlining anti-money laundering checks, so buyers undergo just one verification per transaction rather thanT facing repeated checks.

Transparency

Conveyancers will also face new transparency requirements, with the Government planning to publish performance information showing speed and quality of service, professional specialisms and whether firms support digital practices.

The comparison system, which the ministry claims has already saved consumers an average of £490 per transaction in existing markets, is designed to increase competition and help buyers choose conveyancers more effectively.

The proposed new charter will set out steps for professionals to follow, such as sharing information promptly with lenders, potentially backed by an accreditation system.

However, sellers will, though, face increased upfront costs of £310 for preparing information before listing, as well as survey costs ranging from £300 to £1,500, depending on the survey and property type.

HIPs again?

But legal firm Blick Rothenburg is worried that these proposals are ‘striking similar’ to the much reviled Home Information Packs or HIPs that Labour tried to introduce in 2007.

Its spokesperson Mark Cunningham says: “While the intent behind the new proposals of reducing transaction times and overall costs is welcome, if they increase upfront costs, it will deter sellers just like HIPs.

“If they are to have a chance of success it is imperative that the new information packs provide grease to the home buying and selling process rather than friction.

“The consultation for the new proposals highlights international examples of digital systems that have proven to be successful in reducing transaction times elsewhere. It may be that digital systems could be utilised to streamline the packs and keep upfront costs to a minimum, and hopefully prevent Labour repeating the mistakes of the past.”

If the government of the day when HIPs were abolished had had the bottle to continue with them rather than just getting one over on their predecessor, through the ongoing advances in technology, they would by now have the system they are now trying to create.

The concept is good, but let’s hope the government takes proper input from those of us working on the front line, estate agents, conveyancers, and lenders. These new rules could make a real difference, but only if they’re practical and workable in the real world. For example, will lenders actually accept a survey that’s six months old?