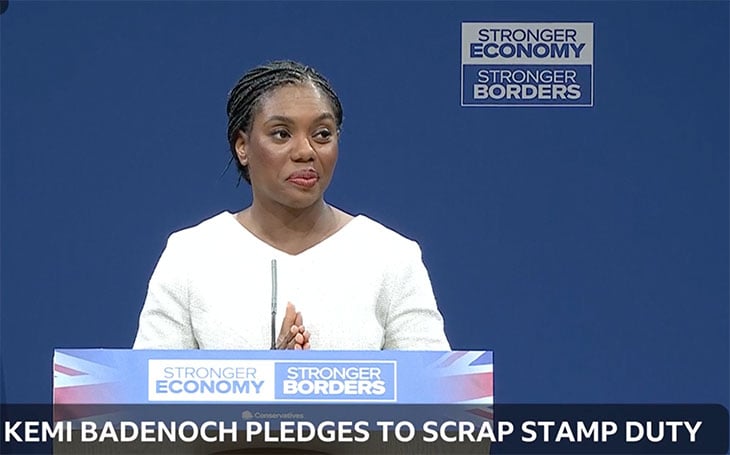

LATEST: Tories to scrap Stamp Duty if they win next election

Conservative Leader Kemi Badenoch made a surprise announcement at her party conference pledging to scrap Stamp Duty completely.

The Conservatives will scrap Stamp Duty altogether if they win the next General Election, party leader Kemi Badenoch announced, although only for primary – not second or buy-to-let – properties.

A surprised Tory faithful heard Badenoch made the pledge as the headline-grabbing climax to her speech in a packed hall in Manchester.

Massive boost

Many of the other announcements in her speech, had been trailed beforehand, but there had been no leaks of the Stamp Duty commitment.

A move to abolish Stamp Duty would give a massive boost to the property industry, and one that many have called for with little hope of it actually being done.

Whether the Tories would be able to deliver such an expensive tax cut, that would apply in England and Northern Ireland, is another matter of course, and Badenoch didn’t explain how it would be paid for.

The party says that the policy will only relate to primary residences irrespective of the price, not to any additional homes, or properties purchased by companies, or by non-UK residents. It would cost an estimated £9 billion, it is reported.

Abolish

Badenoch said: “At the heart of a Conservative Britain is a country where people who wish to own their first home, can.

“But our housing market is not working as it should. The next Conservative government will abolish Stamp Duty.”

Earlier in the week, Shadow Chancellor Mel Stride announced a National Insurance rebate for first time buyers.

Industry reaction

The portal

Richard Donnell, Executive Director at Zoopla

“Stamp Duty hits four in five homeowners and two in five first-time buyers across the country, especially southern England where 60% of all Stamp Duty is paid,” he says.

“We welcome any proposals that remove the financial barriers to moving home. More home moves would support economic growth and the ambition to build more homes.”

The agents

Lucian Cook, head of residential research at Savills

“The impact that abolishing stamp duty would have is largely dependent on what replaces it, given that residential property transactions currently generate £10.4bn for the Treasury,” he says.

“Of that sum £5.5bn comes from people’s primary homes, with £2.6bn of the remaining £4.9bn coming from the underlying rate of tax on investment second home purchases.

“If, and this is a big if, it is a simple tax giveaway, the likelihood is that the current stamp duty bill simply passes through into prices.

“On that basis, that would indicate an uplift in house prices of around 1.4% to 2.1% on average or £5,100 to £7,500 depending on exactly how it is implemented. However, given the way stamp duty works, this would be unevenly distributed across the country’s housing stock with a much greater impact on high value homes, meaning London and the South East would benefit most.

“It is difficult to model what it would do to transactions, but it should free up transactions, especially among the groups that bear the biggest exposure to taxes. With the reliefs already available, it would have the least impact on first-time buyer numbers, with much bigger impacts on mortgaged home buyers and downsizers.

“The impact on investors and second homeowners will be much less, depending on whether they also benefit from a reduction in the underlying rate of tax.”

Tom Bill, Head of UK Residential Research at Knight Frank

“Stamp Duty is the one lever politicians can pull that is guaranteed to have an immediate impact on the housing market,” he says.

“If bond markets feel confident that it has been fully costed and mortgage costs don’t spike, buyers and sellers would warmly welcome the move,” he says.

“It would inevitably have positive repercussions for the wider economy and increase social mobility. The only downside is that if the Tories are leading in the polls ahead of the next general election, the housing market could grind to a halt.”

Dominic Agace, CEO at Winkworth

“It would be an extremely positive step, allowing families to right size for the time in life they are going through,” he says.

“By removing these bottlenecks created by Stamp Duty costs, will lead to a more mobile society, happier in their homes and more flexible in their life choices, which can only be a good thing for the UK and its productivity,” he says.

“There is a concern, however, about what happens to transactions six months before the next General Election if home movers wait to see the outcome.”

The acquisition agency

Jennie Hancock, Founder and Director at West Sussex buying agency Property Acquisitions

“Stamp Duty is such a prohibitive tax, and that was clear for everyone to see when the temporary Stamp Duty holiday was introduced during Covid,” she says.

“In over 30 years of working in the housing market, I’ve never witnessed such an instant and dramatic turnaround in the market,” she says.

“It’s unlikely the Conservatives will have the opportunity to implement this policy any time soon, but my hope is that after three years of property market stagnation, Labour takes note and recognises the vast economic benefits scrapping Stamp Duty would bring.”

The industry leader

Nathan Emerson, CEO at Propertymark

“Across England and Northern Ireland, Stamp Duty has often proven to be a negative pressure for many consumers regarding housing transactions, often placing extra strain and uncertainty within the process,” he says.

“Earlier this year we witnessed the direct effect of stamp duty threshold changes, with a rush to complete on transactions in the lead up to April, followed by an immediate lull in the months that followed,” he says.

“Propertymark welcomes any proposals that bring higher levels of consumer confidence and affordability, helps streamline the buying and selling process, opens additional opportunities to purchase a property for those who aspire to buy, as well as enabling and supporting people to secure a long-term permanent home that fits their needs more easily.”

The homeowners

Paula Higgins, CEO at the HomeOwners Alliance

“We strongly support the Conservative Party Leader’s call to abolish Stamp Duty. We’ve long campaigned to scrap stamp duty for people buying a home to live in,” she says.

“Kemi Badenoch is right: it’s a tax that traps households, hampers mobility and suppresses market activity.

“Homeownership is the foundation of a fairer and more secure society — but stamp duty has denied that opportunity to too many for too lon,” she says.

“Our research shows over 800,000 homeowners have shelved moving plans in the past two years, and stamp duty is a major barrier.”

No need to scrape, just half of it will move the market.

Great. But What will they replace it with?

Easy – more taxes on landlords! It’s Route 1 for this government and the last one: popular with almost everyone, and landlords don’t swing elections. Who are they going to vote for anyway, when every political party is hostile to their interests?

Easy also to increase council tax by forcing councils to increase at a higher rate on Bands E and above, and add new bands at the top to attack, yet again, “those with the broadest shoulders” and own the Magic Money Tree.

They will find a way to make the new owners pay in a different way. Labour are even worse.