Mortgage increases top £1000 as Budget hits loans market

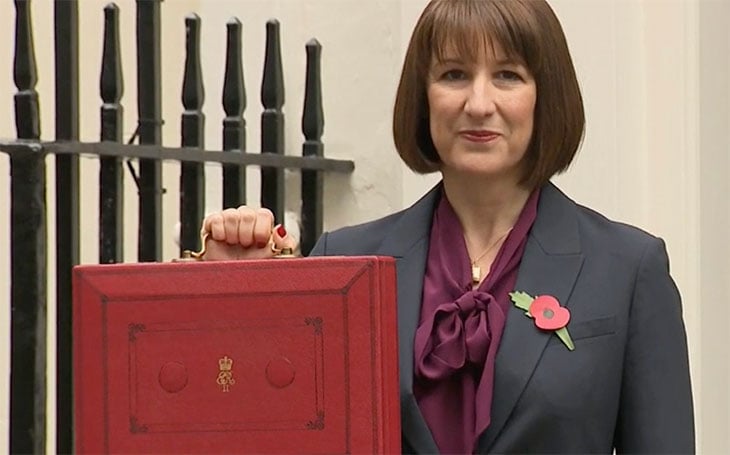

Chancellor Rachel Reeves is under pressure as Government borrowing costs rise sharply and mortgages become more expensive.

The average increase in mortgages tops £1,000 as a result of the Chancellor’s Budget last year, according to the latest figures.

Analysis by the Daily Telegraph shows that property owners who need to remortgage will face a typical extra amount of £1,019 per month.

Increased borrowing costs have heaped pressure on Chancellor Rachel Reeves (main picture) in recent days, as around a quarter raised from tax increases will go on interest payments.

Costs go up

The Telegraph looked at the Office for Budget Responsibility’s (OBR) forecast that average mortgage rates increased from 3.8% to 3.9% after the Budget in October.

Using a Land Registry figure for a typical family home being worth £443,974, with a typical 15% deposit, it means a loan of £377,000.

For someone with a five-year fixed £200,000 repayment mortgage, it adds an extra £541.

And for a variable mortgage this rises to an additional £1,875.

Transactions down

A Treasury spokesman told the Telegraph: “The average two-year and five-year fixed mortgage rates are lower now than they were at the election and someone on a £215,000 mortgage, with a 29-year term length, is paying £40 a month less than they were at the time of the election – or £480 a year.”

HMRC figures released last week showed there was a total of 92,640 residential property transactions in November, an 8% drop from the previous month.

The Bank of England voted to hold its base interest rate at 4.75% in December.

Rachel Reeves’ budget pushes up mortgage costs

Main picture: BBC News