Jitters in prime London market as politics deters buyers

Research chief at Knight Frank says the number of new prospective buyers in London increased between August and September, but was half of that experienced since 2021.

Demand for residential property in the Capital is as fragile as ever with the number of new prospective buyers starts to dwindle, data from Knight Frank suggests.

While the number of new prospective buyers in London rose 12% between August and September it was half the increase experienced in the previous two years. In calmer political times before 2016, the same jump exceeded 40%.

PROSPECTIVE BUYERS

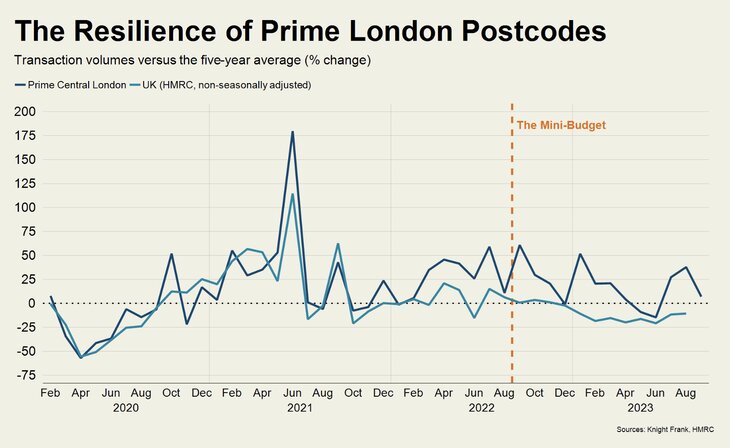

The number of new prospective buyers across the UK was 11% down in the third quarter of this year compared to the five-year average, while the figure for London was up by 13%.

Meanwhile there was a 14% increase in exchanges in the capital while sales volumes fell by 9% across the country.

Tom Bill (main picture), head of UK residential research at Knight Frank, says the main reason for this resilience is the fact average prices are still 16% below their last peak in 2015 in Prime Central London (PCL). In Prime Outer London (POL), they are still 8% down.

Average prices are also 2% lower than they were before the pandemic in PCL, which Bill says helps to explain why transaction volumes were 7% higher than the five-year average in September.

He adds: “In a departure from what took place after the global financial crisis, property prices in London have been far less volatile than the rest of the country during this latest period of economic turbulence.”

Elsewhere, the downwards trajectory for annual rental value growth in prime London markets continued in September as supply increased and demand held steady.

The number of new prospective tenants in prime London postcodes was flat compared to the five-year average in the third quarter of this year.

DECLINE

The number of instructions for lettings properties valued above £1,000 per week in London was 45% higher in September than January 2022. Meanwhile, below that figure, there was an 18% decline.

David Mumby, head of PCL lettings at Knight Frank, says: “I think the market is at a pivotal point. Below £1,000 per week, demand is still ferociously strong but in higher-value markets the time taking to rent is elongating as stock increases. I think we’ll see the rate of growth for prime stock come down further.”

But Bill adds: “We expect 5% growth in PCL next year and 4.5% in prime outer London, which are both still high by historical standards. The last time before the pandemic that rental growth ended the year higher than 5% in PCL or POL was in 2011.

“Supply is picking up more quickly in higher-value markets, as the graph (below) shows.”