Exclusive: Labour’s conveyancing overhaul ‘doomed’ to failure

Chaotic approach to digital IDs will be repeated when Government tries to overhaul home buying and selling, warns Credas boss Tim Barnett.

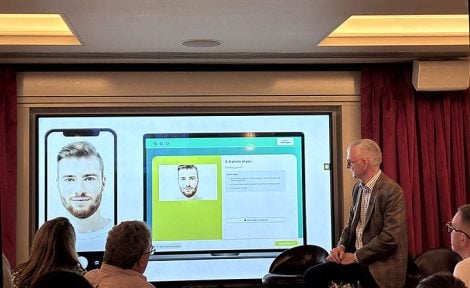

The Government’s promise to radically slash home transaction times risks failure as chaos in the digital identity sector has exposed fundamental flaws in ministers’ approach to the reform programme, says Tim Barnett (pictured), CEO of compliance technology firm Credas.

In an exclusive interview with The Negotiator, Barnett warns that Housing Secretary Steve Reed’s home buying and selling reforms are doomed to repeat the same mistakes that are already being played out in the digital ID sector.

He says: “Everyone is only talking about ID, and I think everyone’s missing the point. We can solve the ID bit, but it’s not going to help the property transaction process because the ID is only one-tenth of the compliance requirement.”

The compliance requirements also include anti-money laundering checks, sanctions screening, politically exposed persons checks, source of funds verification, proof of funds and ongoing monitoring.

Standards chaos

According to Barnett, even understanding the full compliance picture would not be enough without unified standards being laid down by the Government. Currently, different parties across the transaction chain demand wildly different verification levels.

He adds that the Government shows “absolutely no appetite” for taking a leading role in setting those standards. Instead, an “alphabet soup” of industry forums and trade bodies is attempting to fill the gap.

And Barnett is infuriated that, just as the industry was working towards workable solutions, the Government completely upended the system. He says, for years, the property sector had been developing shareable digital IDs using 45 government-certified providers under a trust framework that cost firms over £100,000 each to join, with annual re-certification required.

Then the Prime Minister announced a Government-issued central digital identity system with no consultation, no implementation details, and no mention in the manifesto.

They’ve absolutely thrown a grenade into the room.”

Barnett says: “They’ve absolutely thrown a grenade into the room and haven’t planned for any of that whatsoever, and the responsible department DSIT (Department for Science, Innovation and Technology), doesn’t even know how the system will work.”

Credas currently handles 60% of property sector compliance checks and is on the point of releasing its digital wallet, which allows verified credentials to be shared across multiple transaction parties in order to avoid having to continually repeat the verification process.