London market to ‘bounce back off bottom’ says leading estate agent

Matt Thompson at Chestertons says residential sales in the Capital are set to rebound once the Budget is out of the way.

London’s property market is ready to bounce back once the Budget is revealed next week, a senior agent from Chestertons has predicted.

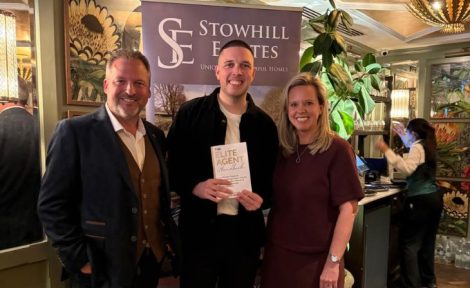

Residential sales in the Capital are at “a turning point”, with inflation stabilising and lending conditions improving says Matthew Thompson (main image), the firm’s Head of Sales.

Bottom of cycle

The market “has reached the bottom of its current cycle, supported by evidence that average prices across London are broadly unchanged year on year,” he argues.

“This combination of stability and selective price adjustments is creating the conditions that typically appear just before confidence returns and the market begins to strengthen.”

Weathered

“The market has weathered Brexit, a global pandemic, political uncertainty and rising interest rates.

“Although some areas, particularly in Prime Central London, have experienced modest price declines, many other postcodes have held firm,” he says.

“What we are seeing now is not a lack of demand but prospective buyers waiting for clarity following the Government’s Autumn Budget.”

Once confidence improves, this pent-up demand will be released.”

Chestertons’ latest analysis shows a pattern that historically appears at the bottom of a market cycle. Prospective buyer enquiries, viewings and offers have all slowed, while property listings have increased.

Thompson adds: “London’s fundamentals remain exceptionally strong. The city continues to expand, international demand is returning and new housing supply still falls short of long-term requirements.

“Once confidence improves, this pent-up demand will be released.”

Tax band warning

Despite Thompson’s upbeat view, London’s expensive market faces a major challenge if rumours that the Chancellor is to increase the higher council tax bands are true.

Accountancy firm Blick Rothenberg says that prices in the Capital are likely to adjust downwards as buyer factor higher council tax bills into their offers, and Blick Rothenberg reckons that could see some properties lose £70,000 in value.

Mark Cunningham, a Partner at the firm, adds: “These reforms are likely to cool demand further at the upper end of the market. In many areas, the types of homes affected were already proving slower to sell and adding extra annual costs will only make buyers more cautious.

“If the charges are only introduced for the top two or three bands, this could lead to a cliff edge effect, resulting in a distorted and potentially inefficient market for properties around the impacted bands.”