Overpriced homes being left on the shelf, says Rightmove

Portal says wobbly economy has created a 'two-speed' housing market but sales levels are beginning to recover.

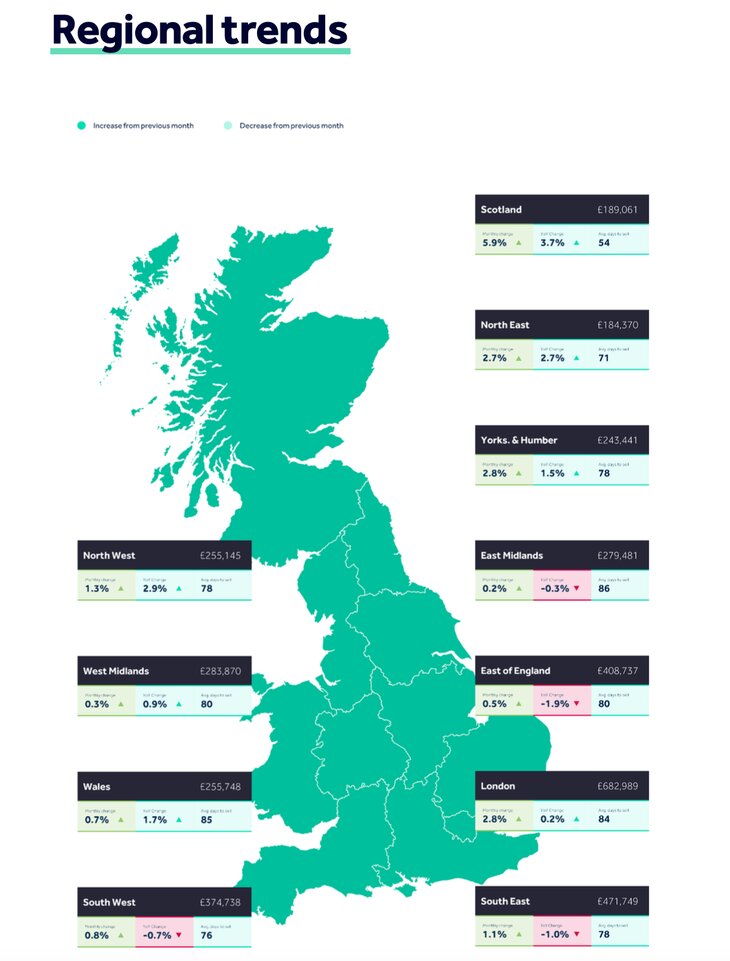

A two-speed housing market with properties that are priced accurately being snapped up whilst over-priced properties are left on the shelf has pushed the average time to sell a house to its slowest level since 2015, data from the Rightmove House Price Index reveals today.

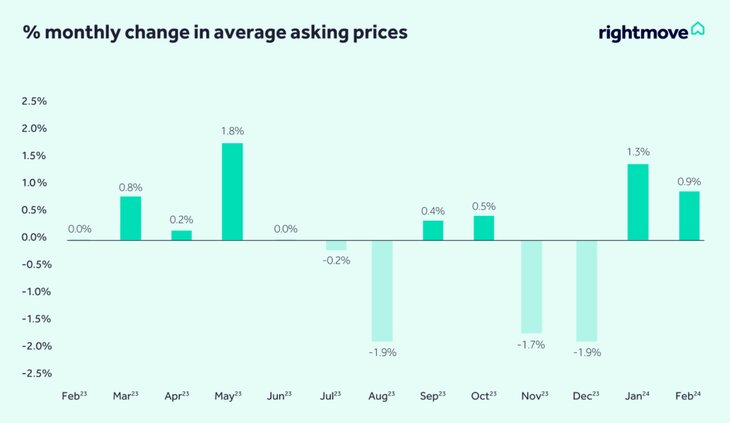

But the latest Rightmove HPI also shows average new seller asking prices have risen by 0.9% (+£3,091) to £362,839 with the annual price change moving back into positive territory after six months of annual price falls, with prices up by 0.1% on a year ago.

Meanwhile, agreed sales in the first six weeks of 2024 are 16% higher than over the same period last year and 3% higher than in the more normal market of 2019.

And increased activity from both buyers and sellers saw 7% more new listings coming to market than last year and a 7% upturn in the number of buyers enquiring.

EARLY-BIRD

Tim Bannister, Rightmove’s Director of Property Science, says: “Early-bird Boxing Day buyers got a head start in cherry picking from a record level of new property choice and have now been joined by many other buyers also believing that 2024 offers the right market conditions to move.

“Mortgage rates have fallen considerably from their peak and are now remaining broadly stable after the uncertainty of late 2022 and 2023.”

He adds: “Sellers who are serious about moving this year would be well-advised to ride this wave of increased buyer confidence with an attractive asking price before any pre-election jitters or unexpected events dampen the momentum.”

Michelle Niziol, Chief Executive at IMS Property Group in Oxfordshire, says: “There’s a sense of optimism, helped hugely by mortgage rates dropping in recent months, which now seem to have settled and remained stable, giving prospective buyers assurance and confidence.

“With lower mortgage rates on offer and more properties for sale, now is a good opportunity for any would-be buyers out there. Despite the affordability constraints there is a good audience of buyers out there for properties priced well, also providing opportunities for those looking to sell.”

Kate Eales, Deputy Dead of Residential at Strutt & Parker, adds: “Optimism breeds confidence and confidence is translating into more sellers and buyers coming into the market.

TRENDING UPWARDS

“Activity is trending upwards compared to this time last year, which is encouraging, but the market remains price sensitive. Buyer’s budgets are still being largely constrained by expensive mortgage products, so it’s a careful balance.”

And Jimmy Waight, Head of Sales at John D Wood & Co. in London, says: “We are witnessing a good start to the year in London’s property market, with buyers acting earlier than usual.

“The surge in activity can be attributed to the decreasing and now stabilising mortgage rates which have prompted many individuals who postponed their moves last year amid uncertainty to now re-emerge.

“This positive trend suggests a renewed confidence in the market, and as we move into spring, we anticipate a continued upward trajectory in both buyer interest and property transactions.”