Housing market ‘not facing Armageddon’ says leading researcher

Difficult times are coming but figures don’t signal disaster – 'unless we talk ourselves into it' says Davy Research.

The UK housing market is not facing Armageddon, despite media reports to the contrary.

That’s the message from Davy Research, which says that while difficult times are coming it’s not the end of the world.

But it warns: “It is undoubtedly possible to talk oneself into a market collapse.”

The firm’s November UK housing snapshot shows that October’s mortgage approvals fell 10.6% to 58,977, 12% below the 10-year average.

Zoopla also noted a 40% transaction fall-through rate in October. Meanwhile mortgage rates grew by 170-180 basis points across 75% loan-to-values (LTVs), which are now 207%, 101% and 65% above their 10-year averages, respectively.

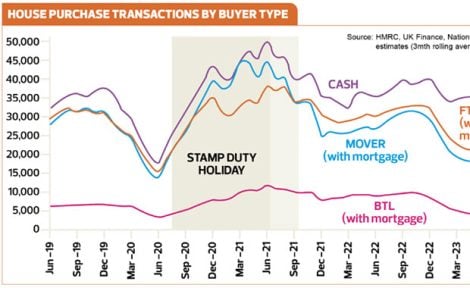

However transactions rose 2.3% in the October, 7.8% higher than the 10-year average.

Challenging month

“With a new monarch, two new prime ministers, three new chancellors and a career-ending mini-budget, October was a very challenging month for the UK housing market,” said David Reynolds, analyst at Davy.

“Valuations will correct and mortgage rates will stabilise; we don’t think the data point towards Armageddon, although October was extraordinary.

“Estate agents will be squeezed by rising fall-out rates and, as we have said before, Rightmove would need Armageddon and mass agency failures to buckle.”

Market confidence recovering

The report also cites data from the Twindig housing market index, a measure of confidence in the UK housing market.

The index started on 1 January 2020 with a value of 100 and fell dramatically during the first phase of the pandemic, but has been recovering since.

November saw an 8.7% increase in the index to 66.4.

“Rather than a great shift in sentiment, this is more a return to where we would be without October’s mini-budget,” said Reynolds.

“The market is reacting more positively towards Hunt’s budget but the latest index measurement is pre mortgage-approvals data – which could cause a decrease.”

Shame this doesn’t acknowledge the cost of living increases except in relation to mortgages. £400 a month that might have funded a mortgage of £80,000 but now will likely be the average impact on household budgets can’t be ignored. That said, if the alternative is to rent, then those are already higher in many instances than mortgage payments and unlike mortgages, they can’t be fixed. I imagine there will be many recent ft buyers fixing or capping their mortgages, finding a port in the storm. Were it not for that then I think the market would indeed be facing Armageddon. I wouldn’t want to be a young person striking out for independence at this time. Rocks and hard places.