Prime prices fall but ‘under offers’ and new instructions rise

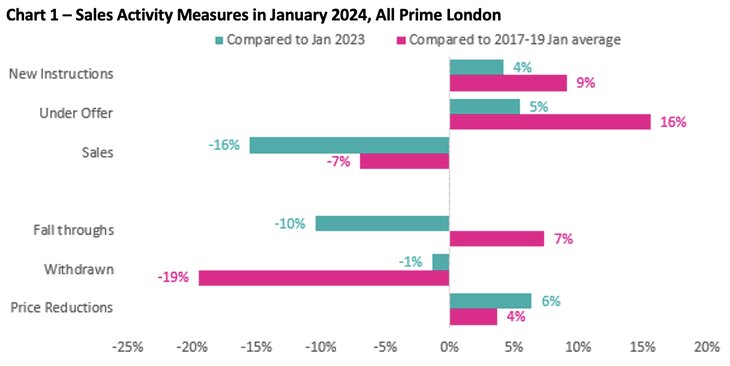

There were 15.5% fewer transactions in January compared to last year and 6.9% fewer than the pre-pandemic January average, says LonRes.

Average achieved sold prices across Prime London market fell by 7.1% in January – the largest fall in almost five years, analysis of the prime London housing market by LonRes reveals.

But despite the falls the number of properties going under offer grew by 5.4% while the number of new sales instructions increased by 4.2% over the same period while fall-throughs and withdrawals also fell.

PRE-PANDEMIC

However there were 15.5% fewer transactions in January compared to the same month a year earlier, and 6.9% fewer than the 2017-2019 (pre-pandemic) January average.

The £5 million plus market continued its return to more normal activity levels after a strong two years. Sales in January were 17.2% down on a year earlier but ahead of the 2017-2019 (pre-pandemic) January average, by 63.6%.

New instructions in this market rose in January by 41.2% compared to a year ago, while the number of properties going under offer was unchanged over the same period.

Meanwhile the pace of annual rental growth across prime London slowed to 3.1% in January, taking values to 26.1% above their 2017-19 (pre-pandemic) average.

LonRes says that the declining number of fall throughs, withdrawals and price reductions – indicate a relatively healthy market.

It adds: “Fall throughs and withdrawals in January were lower than a year ago and price reductions are only 6% higher.

“With under offer numbers looking significantly better than sales, this continues to lend evidence to the theory that deals are being agreed but are just taking longer to conclude.”

STILL INCREASING

January also saw activity in the £5m+ market, like those pictured in Primrose Hill, continue to slip back but transaction levels are still well ahead of historical trends and the supply of high-end homes for sale appears to still be increasing.

New instructions in January this year were 42% higher than last year and 148% more than the 2017-19 January average.

Nick Gregori, LonRes Head of Research, says: “Sentiment appears to be gradually improving for the prime London sales market.

“Under offer numbers – the timeliest indicator of demand – grew by 5.4% in January on an annual basis and were 15.6% ahead of the longer-term average. New instructions grew by 4.2% compared to a year earlier.”

He adds: “The top end of the market is the most active – on a relative basis – as it has been since late 2021. Supply in this market continues to grow, with new instructions in January 42% higher on an annual basis and the number of homes available for sale growing by over 50% in the past 12 months.”