Rents rising slowing but tenants still face affordability squeeze, says Zoopla

Portal's Richard Donnell says there’d no immediate prospect that rental affordability will improve in 2024 despite rental inflation predicted to halve.

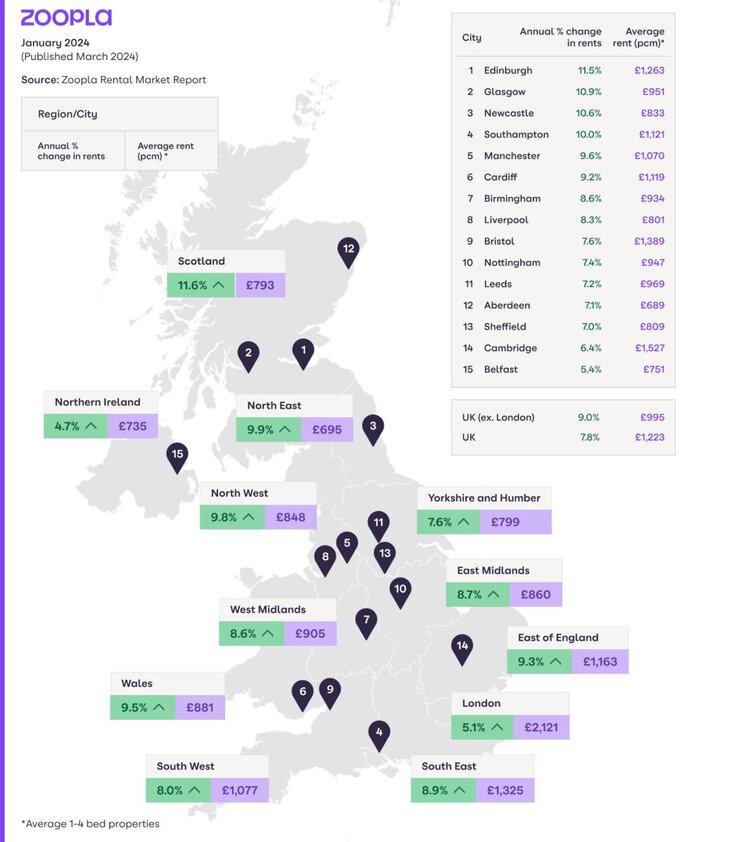

Rent inflation has slowed to 7.8%, down from 11% a year ago – the lowest rate for two years – with the average now at £1,223 a month, the latest Rental Market Report from Zoopla reveals.

Overall rent inflation is predicted to halve over 2024 to 5% with average earnings growth to slow to just below 4% – meaning that there is no immediate prospect that rental affordability will improve.

SUPPLY AND DEMAND

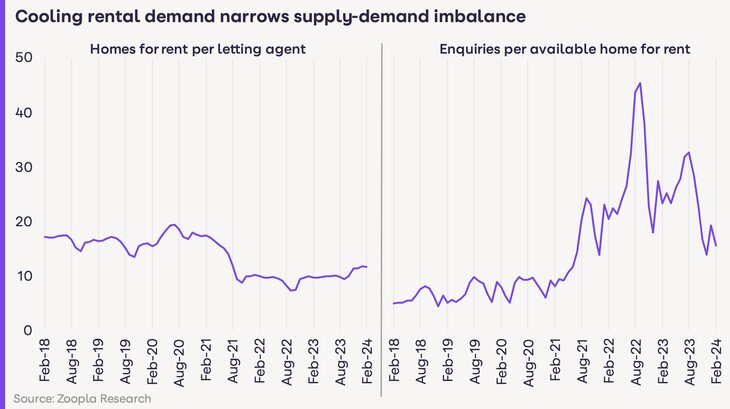

The slowdown in rental growth is mainly due the imbalance between supply and demand starting to narrow, with the average letting agent listing 12 homes available for rent – a fifth higher than this time last year but still over a quarter (28%) lower than the pre-pandemic average.

Meanwhile the typical home for rent is seeing 15 enquiries, down from 40 enquiries per property in 2021 but still double pre-pandemic levels.

In London rents are up by just 5.1%, down from 15.3% a year ago while across the rest of the UK rental inflation is broadly in line with a year ago despite weakening demand.

Rents continue to rise fastest in Scotland (11.6%) – the only area where rental inflation remains in double digits.

IMBALANCE

Richard Donnell (main picture), Executive Director at Zoopla, says: “The last two years have been characterised by an ongoing imbalance between rental supply and demand.

“This has pushed rents for new lets 30% higher since 2021 adding to cost of living pressures for renters.”

And he adds: “The imbalance between supply and demand has started to narrow but is far from closed.

“Rents for new lets will continue to rise over 2024, albeit at a slowing rate. Rents remain at their most expensive compared to average earnings for over a decade.

“Only a rapid and sustained expansion in rented housing will start to improve affordability for UK renters.”

I have a solution: Increase supply of available properties to rent.

Politicians; STOP DEMONISING THE PRIVATE RENTAL SECTOR.

Encourage landlords to rent their properties. Bring back tax relief on mortgage interest. Abolish ‘selective licensing’. Amend the ‘Renter Reform Act’ – keep fixed term tenancies. Does sect 21 really need to be abolished? Probably not……

Stock will increase. Rent prices will fall. Job done. Simples.