How to sell a lot

Only a few years ago, auctions were seen as a last resort to shift a difficult property or make a quick sale where needed. All that has changed, as Charlotte Flake discovered.

The somewhat forced move from physical to online auction events has been instrumental in blowing the auction market wide open. Coupled with the buying frenzy that ensued once the market re-opened and the Stamp Duty Holiday was announced, it’s now a sophisticated sale model being used by all kinds of buyers, a growing number of sellers and thousands of agents on a much more regular basis.

So much so, that properties sold at auction during the past 24 months has increased 40 per cent, with those supplied by agents reportedly doubling. Auctions are no longer just seen as a vehicle for cash investors to buy rundown or problem properties below market value. With stock levels at an all-time low and some 30 buyers for every residential property available, consumers are looking for speed and certainty in their property hunt. And agents, helped along nicely by the increasing uptake of the ‘Modern Method of Auction’ (MMoA), have been driven by this consumer demand along with the need to differentiate themselves from competitors.

Benefits of property auctions

The benefits for all involved seem endless too. Sellers and buyers can significantly increase their chances of success, with fall-through rates dropping to under one in 10 compared to a third via the traditional estate agent model. Competitive bidding in the current market means properties are likely to sell for a similar figure to that achieved on the open market too – if not more – and in less than half the time.

For agents, auction options add yet another service to their portfolio, can generate the same or even higher fees and improve cashflow. And of course, auction providers can access an even wider audience. Those estate agents yet to explore the option to add an auction service to their arsenal should certainly consider the ever-increasing opportunities. Whether you’re looking to dip your toe in the water, need a flexible alternative or a permanent partnership, the choice is yours.

Agent referrals rife

Referring a property to a traditional auction house is a simple and straightforward process in most cases. Usually reserved for ‘typical’ problem properties or those that may not garner much interest on the open market, live auctions offer a quick ‘get-out-of- jail-but-still-earn-a-fee’ card for agents.

Referring a property to a traditional auction house is a simple and straightforward process in most cases. Usually reserved for ‘typical’ problem properties or those that may not garner much interest on the open market, live auctions offer a quick ‘get-out-of- jail-but-still-earn-a-fee’ card for agents.

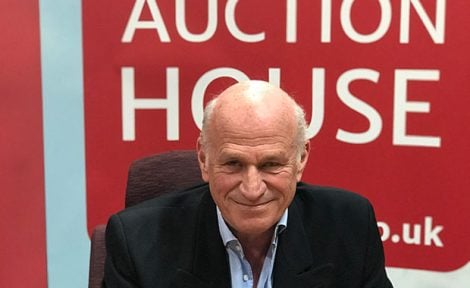

As Bryan Baxter, Director of Auction House East Anglia, explains, “We take instructions from agents either at the point of valuation when the agent realises that the property would be best sold at auction or after they have been marketing for a while and the property has failed to sell due to various reasons, e.g. when there is an adverse survey or the vendor is getting anxious for a quick unencumbered sale.”

Selling a run-down property via an auction takes all stress and time commitment away from an agent… no viewings, negotiating offers, surveys, legal issues… Bryan Baxter MD, Auction House UK.

Across the whole of Auction House UK, around a quarter of lots are from introducer agents, rising to a third in East Anglia. In such cases, fees are shared equally with agents. These may be more than the standard agent fee, but the seller can almost guarantee a fast sale and the entire transaction is handled by Auction House.

“Selling a run-down property via an auction takes all stress and time commitment away from an agent,” adds Baxter. “There would be no viewings, negotiating offers, sales chasing, surveys, legal issues, renegotiating or abortive sales and the fee is paid on exchange of contracts ensuring a far quicker cash flow.”

Neil McDonald, Director of Town & Country Auctions, which also has a traditional sales and lettings arm, offers similar agent partnerships for around 200 property sales a year. “We only with partner with agents who provide auction stock that we believe has a very good chance of selling and achieve a 90 per cent success rate as a result,” says McDonald. “Fees are higher for agents and there is more certainty in sale. Some properties are also likely to sell for a higher price at auction than private treaty.”

Neil McDonald, Director of Town & Country Auctions, which also has a traditional sales and lettings arm, offers similar agent partnerships for around 200 property sales a year. “We only with partner with agents who provide auction stock that we believe has a very good chance of selling and achieve a 90 per cent success rate as a result,” says McDonald. “Fees are higher for agents and there is more certainty in sale. Some properties are also likely to sell for a higher price at auction than private treaty.”

We only with partner with agents who provide auction stock that we believe has a very good chance of selling and achieve a 90 per cent success rate.

Neil McDonald, Town & Country Auctions.

Both companies credit the change in public perception as one of the reasons behind more agents looking to utilise auctions and both also offer agents franchise opportunities – white-labelled with Town & Country or under the Auction House brand.

Kal Sangra, Director and Auctioneer at Shonki Brothers agrees. “Sellers and buyers have become more knowledgeable about auctions and therefore all types of properties, in any condition, are suitable for auction.”

Kal Sangra, Director and Auctioneer at Shonki Brothers agrees. “Sellers and buyers have become more knowledgeable about auctions and therefore all types of properties, in any condition, are suitable for auction.”

The Leicester-based independent agent set up its own auction arm in 1992 and remains one of the only local auction houses in the area. Since 2020, the firm has sold 100 per cent of the properties they have received joint agency instruction on in addition to the lots they receive vendor instruction on – around 150 a year.

If we increased our fee to provide incentives to estate agents, it goes without saying that these fees will be chargeable to someone in the chain, most likely the buyer.

Kal Sangra Director, Shonki Brothers.

Sangra, says, “Agents, both commercial and residential, normally approach us as a last resort to selling a client’s property. Despite an estate agent being already involved, a full auction service is provided with a valuation being conducted.”

In respect of fees, Shonki Brothers charge the seller a joint agency fee of 1.5 per cent to two per cent of the sale price compared to its usual one per cent to 1.5 per cent, which is split equally with the agent. “We do not achieve as much but receiving instructions and sharing equally the fee is not something we worry about,” comments Sangra. “It is always an honour to work with a fellow professional in getting a property sold.”

Although Sangra is aware that other auction houses charge higher fees, with the bill usually footed by the buyer, he claims this only impacts the final sale price. He adds: “If we increased our fee to provide incentives to estate agents, it goes without saying that these fees will be chargeable to someone in the chain, most likely the buyer. The higher the fees, the more likely buyers will offer less for the property.”

This is also the perspective of Pugh Auctions, as Associate Director, Will Thompson, explains, “There is a lot of talk about the fees that agents can earn from working with an auction house; that’s understandable because the fees are indeed attractive but, in my experience, agents are primarily concerned with vetting the process and the service their clients will be involved in. “Whether it’s a long-term strategic partnership or just an occasional joint-agency sale, most of the time, the agents want to know if an auction house can be trusted to deliver results, which I think is great!” Pugh Auctions doesn’t require agents to sign an exclusivity agreement, instead working alongside them to understand the needs, which can be different for each property and each agent.

This is also the perspective of Pugh Auctions, as Associate Director, Will Thompson, explains, “There is a lot of talk about the fees that agents can earn from working with an auction house; that’s understandable because the fees are indeed attractive but, in my experience, agents are primarily concerned with vetting the process and the service their clients will be involved in. “Whether it’s a long-term strategic partnership or just an occasional joint-agency sale, most of the time, the agents want to know if an auction house can be trusted to deliver results, which I think is great!” Pugh Auctions doesn’t require agents to sign an exclusivity agreement, instead working alongside them to understand the needs, which can be different for each property and each agent.

Whether it’s a long-term partnership or just an occasional joint-agency sale, the agents want to know if an auction house can be trusted to deliver results.

Will Thompson, Pugh Auctions.

Thompson adds, “Personally, I think this is very enticing to agents because it allows them to feel they can come and go if they wish, rather than feel an expectation to refer a minimum number of properties to us. Plus, having a standard agreement for agents to sign is not the approach we want to have. You only need to converse with a handful of agents to understand a one-size-fits- all policy won’t work. We let the agent do the talking to understand how the auction service, process and partnership needs to work for them and their clients.”

Taking regular auction action

In an increasing number of cases, as alluded to above, agents also have the option to form a more formal and regular partnership with auction providers in the shape of a franchise or serviced auction arm.

The former would include the usual franchise set-up costs and ongoing fees but with a likely higher margin on fees earned from the sale. The latter has a variety of operating models which could include subscription fees and/or a split on the commission.

As well as flexible options with Town & Country Property Auctions, Auction House UK and Pugh Auctions, some other major players who have capitalised particularly on the MMoA movement are Iamsold, Whoobid and My Auction.

Offering agents more of a middle ground, this model extends the completion time from 28 days to 56 days post-auction. This gives buyers more time to finalise finance or other arrangements and therefore entices a bigger pool of buyers and attracts a range of properties.

As Jamie Cooke, Managing Director of Iamproperty, puts it: “Thankfully, auction no longer conjures up images of abandoned buildings being sold in a ‘Homes Under the Hammer’ ballroom.” As one of the companies which has pioneered MMoA, Iamproperty’s auction service, iamsold, welcomed 495 new partner agents and sold 5,023 properties through the network in 2021. This is an increase of 29 per cent on the previous year, with over £17m in fees being paid out to partner agents, often within as little as seven days, and with at a successful sale rate of 95 per cent.

As Jamie Cooke, Managing Director of Iamproperty, puts it: “Thankfully, auction no longer conjures up images of abandoned buildings being sold in a ‘Homes Under the Hammer’ ballroom.” As one of the companies which has pioneered MMoA, Iamproperty’s auction service, iamsold, welcomed 495 new partner agents and sold 5,023 properties through the network in 2021. This is an increase of 29 per cent on the previous year, with over £17m in fees being paid out to partner agents, often within as little as seven days, and with at a successful sale rate of 95 per cent.

Typically, estate agents come to us when they are looking to enhance their service offering, meet the demands of their clients and win more instructions.

Jamie Cooke MD, Iamproperty.

The decision to provide an auction offering is a business one that benefits both agents and sellers says Cooke. “Typically, estate agents come to us when they are looking to enhance their service offering, meet the demands of their clients and win more instructions,” he comments. “In times when it’s more difficult to win instructions, offering MMoA is a strong differentiator that helps agents to gain a competitive edge.”

Cooke adds, “In addition to being able to stand out in the market and offer clients more options to match their individual circumstances, auction gives our Partner Agents additional revenue streams and the opportunity to complete sales faster.

“MMoA alleviates the pressure on them and their workload, while still delivering the results and income that they need to satisfy clients and reach targets.”

Iamsold does more than just facilitate an auction service and nurtures a close relationship with every agent branch, giving them access to an account management team, training and a learning portal.

From a seller perspective, Cooke claims they get the best of both worlds, “Their transaction is supported by our auction expertise and regular communications from their dedicated auction specialist, as well as benefitting from their chosen estate agent’s local knowledge to get a personalised service that feels seamless.”

With this type of model, sellers usually pay for an auction pack with the commission being charged to the buyer – 4.2 per cent of the property price or a minimum in £6,000 in this case – meaning agents can sometimes be earning double.

Another online auction provider is Whoobid and they don’t charge sellers commission either, also putting all the fee onus on the buyer and giving agents a majority split of 60 per cent.

It could be argued that this reduces the number of potential buyers to serious and experienced ones, but Director, Doug Haigh, says that the certainty is driving demand.

“We’ve seen a significant shift in the perception of auctions change,” comments Haigh. “Three years ago we would be regularly having a ‘my property isn’t suitable’ conversation but now we regularly sell penthouses, high end detached properties and well as the expected dilapidated properties and HMO’s etc. We find now people are looking for security due to being messed around or chains falling through.”

A newer player to this arena, although by no means new to the property market, is Stuart Collar-Brown. The former estate agent and auctioneer of 13 years and NAVA Propertymark board member launched My Auction two years ago with a view to providing a ‘fresh approach to online auctions’.

Since then, over three quarters of the successful auction sales have been referred to them via estate agents who all earn their full fee.

Collar-Brown comments: “Our intention is to create a very fair and equal relationship with the estate agent utilising each company’s strengths and skills to maximise the sale price for the seller.”

“The decision to put a property into auction from an estate agent’s point of view should be because it’s the best advice for the client – not because of the fees they will earn,” he adds. “We believe the agent should earn the same regardless of how the property is sold and likewise, it should not cost the seller any more to sell via auction than it does to sell on the open market.”

My Auction is structured in a way that requires the agent to do their usual marketing and viewings for the four weeks prior to auction while the company carries out specific auction marketing before facilitating the whole sale using its own software and website. The agent keeps 100 per cent of their usual fee and My Auction charges one per cent plus VAT to buyers, with a minimum fee of £2,000.

The timeframe from going live to legal completion should be no more than eight weeks, following the traditional model of exchange on the day of auction.

“I am a traditionalist when it comes to auction,” says Collar-Brown. “With that said, I can’t deny that the introduction of the modern method of auction has increased the number of what I would call ‘normal houses’ being sold at auction – this is a good thing for the industry if done fairly for all parties.”

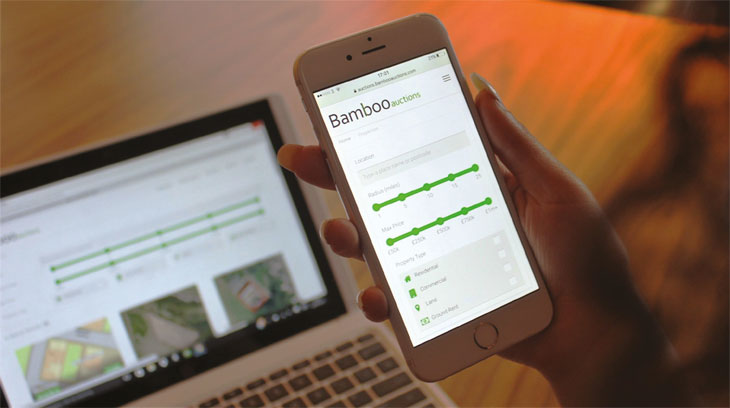

Investing in tech

One way to start testing the water is to use a free service like Bamboo, which only charges agents on their sale success. Its online technology makes the agent the auctioneer, integrating into an agent’s website. Agent training is provided, but essentially, they retain complete control and responsibility of the whole process and fee structure. Over 1,000 properties have been sold using this platform in the last 12 months, raising £230m in sales and with a fall-through rate below one per cent.

According to Robin Rathore, the company’s founder and director, Covid has certainly proved a catalyst in growing the online auction market. “We have noticed a domino effect in the world of proptech with agents adopting new technologies and services as part of their everyday business uses and this, in turn, has created a new market for agent adoption to new and evolving technologies such as Bamboo Auctions,” says Rathore.

According to Robin Rathore, the company’s founder and director, Covid has certainly proved a catalyst in growing the online auction market. “We have noticed a domino effect in the world of proptech with agents adopting new technologies and services as part of their everyday business uses and this, in turn, has created a new market for agent adoption to new and evolving technologies such as Bamboo Auctions,” says Rathore.

We have noticed a domino effect in the world of proptech with agents adopting new technologies and services as part of their everyday business.

Robin Rathore Founder, Bamboo.

“According to our latest research, we have seen an increase in the last six months of agents joining Bamboo increase by 40 per cent month on month.”

The very nature of online auctions and changing buying habits of consumers has also impacted the demographics of buyers and sellers as well as property types, claims Rathore. “We have seen an increase in the number of younger buyers and first-time bidders in the residential sector and approximately 50 per cent of bidders on our platform are women.

“It’s not just young people who are bidding on our platform either – for the last two years, older bidders have had to adopt ‘new’ technologies, and the convenience of being able to bid online has created new advocates for the online auction space.”

As a result, the expected fixer-uppers and development opportunities are now up for auction alongside an increasing number of owner-occupied properties, which are being bought by first-time auction buyers.

Offr also powers online auctions at the press of a button on agent websites. The proptech firm, which claims to have facilitated the first digital property transaction in March 2020, charges a monthly licence fee with no upfront set up costs and a 0.1 per cent transaction fee on the completion of sale.

Co-Founder and CCO, Philip Farrell, sums up the service: “The agent provides the expertise, market knowledge, and access to a bank of active purchasers. We deliver a button which sits on the individual property details on their website, in their colours. With this button, they conduct an online auction in a secure, user-friendly environment. To date, Offr has sold over 500 properties by unconditional auction for agents and many hundreds more via the conditional sale method.”

Co-Founder and CCO, Philip Farrell, sums up the service: “The agent provides the expertise, market knowledge, and access to a bank of active purchasers. We deliver a button which sits on the individual property details on their website, in their colours. With this button, they conduct an online auction in a secure, user-friendly environment. To date, Offr has sold over 500 properties by unconditional auction for agents and many hundreds more via the conditional sale method.”

We deliver a button which sits on the individual property details on their website, in their colours. With this button, they conduct an online auction.

Philip Farrell Co-Founder, Offr.

Like Offr, Under the Hammer aims to save agents a considerable amount of time by combining auctions and automation and maximises success rates by offering an eight-week completion.

“A property which allows a buyer 28 days to complete limits its audience, hence suiting to problematic properties and cash buyers,” says Group CEO, Indy Dubb. “However, the Under the Hammer platform allows agents to offer eight-week completions, which targets almost every possible buyer. Not only that, but we also have a heavy focus around technology and automation, and as a result, agents who are using our platform are saving up to 80 per cent of their time when compared to Private Treaty.”

“A property which allows a buyer 28 days to complete limits its audience, hence suiting to problematic properties and cash buyers,” says Group CEO, Indy Dubb. “However, the Under the Hammer platform allows agents to offer eight-week completions, which targets almost every possible buyer. Not only that, but we also have a heavy focus around technology and automation, and as a result, agents who are using our platform are saving up to 80 per cent of their time when compared to Private Treaty.”

When we look at the definition of ‘auction’ it is in fact ‘to find the highest bidder for any goods or property’. And that’s what a lot of agents are doing right now.

Indy Dubb CEO, Under The Hammer Group.

Under the Hammer is a 24/7 digital service supported by a team who take care of everything from arranging viewings, collecting offers and AMLs and sales progression, when needed. Agents will receive a five per cent deposit from the buyer on the day and a fixed timescale for completion.

Dubb continues; “Agents are loving the fact they can win more instructions by offering so much more value to their clients. Let’s not forget, we are probably the only industry that doesn’t get paid or part paid for anything until it gets over the line, however by agents using our platform, they are being paid on every sale. With uncertain market conditions for buyers too, they also want to know that they are agreeing to purchase a property that is theirs and they have that security.”

No ‘one-size-fits all’

The mainstream movement of auctions cannot be denied and even some of the largest portals now have an auction functionality, putting bidding buttons in the direct eyeline of buyers. So it’s not so much a question of if agents should embrace auctions, but when and in what format. There are clearly plenty of options and which one you consider will largely depend on: the goals of you as an individual and property professional; your branch and its service offering; and, of course, your vendor.

With Google Trend data indicating that online consumer search interest in ‘Modern Method of Auction’ has soared 130 per cent since January 2019, we can be confident that enquiries will rise. But will agents be ready to effectively operate in what is notoriously a complex arena?

One issue that My Auction’s Stuart Collar-Brown foresees is that a lack of regulation and specialist training could lead to costly mistakes. “I would like to see our industry become regulated the same as the financial and insurance professions,” says Collar-Brown. “This means no estate agent can give advice on property auctions unless they have the relevant qualification in auctioneering, or work with an auction house where all of their staff hold the relevant qualifications from a professional body. This would increase the profile and reputation of the property industry as a whole.”

One issue that My Auction’s Stuart Collar-Brown foresees is that a lack of regulation and specialist training could lead to costly mistakes. “I would like to see our industry become regulated the same as the financial and insurance professions,” says Collar-Brown. “This means no estate agent can give advice on property auctions unless they have the relevant qualification in auctioneering, or work with an auction house where all of their staff hold the relevant qualifications from a professional body. This would increase the profile and reputation of the property industry as a whole.”

The modern method of auction has increased the number of what I would call ‘normal houses’ being sold at auction– this is a good thing for the industry.

Stuart Collar-Brown Founder, My Auction.

Having said that, the activity in both sectors of the market have many similarities already, as Under the Hammer’s Indy Dubb explains: “When we look at the definition of ‘auction’ it is in fact ‘to find the highest bidder for any goods or property’. And that’s what a lot of agents are doing right now given the current market conditions, as the majority of sales are going to be best and final, but without providing the security and with no guarantee the sale will actually go through to completion.”

It’s now a case of formalising this process, getting the right training and education or partnering with an auction provider who can not only boost your service but your bottom line too.

AGENT AUCTION OPTIONS QUICK GUIDE

1 Introduce

1 Introduce

Refer properties on a case-by-case basis, hand over the ‘hassle’ and share the fee.

2 Partner

Commit internally to adding auction services to your arsenal and strike up agreements with auction providers on an ongoing basis, combining your expertise and sharing the fee and the workload.

3 Franchise and Expansion

Piggyback on tried and trusted brands in the sector with the infrastructure behind it whilst still offering traditional Private Treaty sales and retain the majority of your fees.

4 Tech

Educate yourself on the auction process and integrate tech to your existing online offering to facilitate this sale method and achieve a higher margin, but potentially trade more time for money.