Housing ‘no place for dirty money’, says NAEA

The NAEA wants an end to corrupt money, while Landlord Action has welcomed proposal to crackdown on rogue landlords.

The NAEA has joined forces with the Transparency International to oppose money-laundering in the estate agency sector.

The NAEA has joined forces with the Transparency International to oppose money-laundering in the estate agency sector.

The NAEA and the anti-corruption body want to see four major changes introduced to the sales and purchase process in a bid to combat the problem. This includes ensuring that all foreign companies are transparent over their ultimate beneficial ownership of property titles in the UK, anti-money laundering checks are carried out by estate agents on the purchaser, as well as the seller of high-value property, make sure that agents adhere to anti-money laundering regulations, and that meaningful punishment and sanctions are imposed on agents who break the rules and support criminal money laundering.

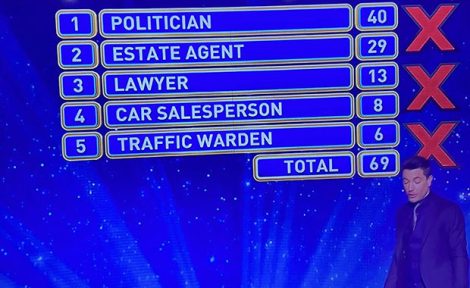

Following on from the Channel 4 ‘From Russia with Cash’ documentary in the summer, the NAEA’s Mark Hayward said that there is still ‘not absolute clarity’ in relation to anti-money laundering among those in the property sector, despite the very clear legislation in place and regular training and updates from within the industry.

“It is now time to step up the level of scrutiny that the sector comes under to ensure that a small minority of agents do not support criminal activity and those that do are appropriately sanctioned,” said Hayward (left).

“It is now time to step up the level of scrutiny that the sector comes under to ensure that a small minority of agents do not support criminal activity and those that do are appropriately sanctioned,” said Hayward (left).

His comments were supported by Nick Maxwell, Head of Advocacy and Research at Transparency International.

He said, “The rhetoric from the Prime Minister about stopping the flow of corrupt capital coming into the UK has been very strong, but now is the time for real action. The veil of secrecy over UK property ownership needs to be lifted to ensure the UK is no longer a safe haven for dirty cash and we look forward to working with the Government to this end.”

Meanwhile, the Government’s latest proposal to crackdown on rogue landlords, particularly those who carve up properties to creative multiple sub-standard sized rooms in a bid to maximise their rental income, has been warmly welcomed by Paul Shamplina (right), Founder, Landlord Action.

Meanwhile, the Government’s latest proposal to crackdown on rogue landlords, particularly those who carve up properties to creative multiple sub-standard sized rooms in a bid to maximise their rental income, has been warmly welcomed by Paul Shamplina (right), Founder, Landlord Action.

Shamplina believes imposing a minimum square footage per room, as a legal requirement, will help reduce the number of over-crowded, unsafe homes. However, he warns it will not prevent sub-letting scams, which are often the lead cause of “rabbit-hutch rooms”, and will require greater enforcement resources to be effective.

The consultation paper explores the options for extending the scope of mandatory licensing of HMOs to smaller and medium sized properties, but Shamplina, who has been part of a Government ThinkTank regarding key legislative changes to the buy-to-let industry, insists that only a small proportion of landlords abuse the system in this way.

“Nevertheless, they are guilty of exploiting the vulnerable whilst profiting from the housing crisis, particularly in the capital. Therefore, anything which helps to eliminate this problem and impose proper sanctions in the case of violation, is a positive step forward,” he said.

However, according to Shamplina, there are two key hindrances with these proposed new measures; enforcement and sub-letting.

He added, “One of the biggest problems with implementing any new legislation is enforcement. Local councils do not have enough resources as it is, with Environmental Health Officers (EHO) already responsible for monitoring overcrowding, sub-letting, poor conditions, and most recently retaliation eviction. There is no room in our sector for rogue landlords, but to tackle the problem properly, legislation needs to be backed up by more boots on the ground.”

The problem surrounding are not just rogue landlords, but in fact tenants posing as landlords and sub-letting properties to unaware tenants, according to Shamplina.

He reports that his firm has never seen so many sub-letting cases as it has over the last two years, with an 18 per cent rise. This, Shamplina insists, has been fuelled in part by “sky high rents” preventing some tenants from being able to afford even single-unit accommodation, “forcing many to resort to bedsits or shared accommodation”.