Agents and landlords reveal ‘extreme concern’ over Hunt’s tax plans

Reports over weekend reveal Chancellor hopes to raise £300m from private rented sector to fund his tax cutting.

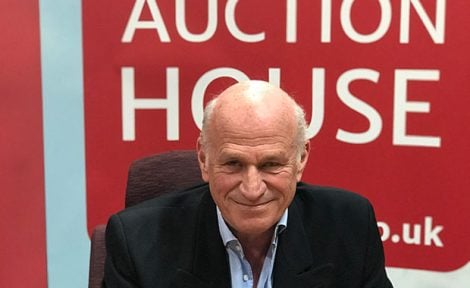

Concern is rising among agents and landlords after sources within the Treasury revealed over the weekend that Jeremy Hunt (main picture with team) is planning a tax raid on the private rented sector within his Budget on Wednesday.

The Sunday Times has claimed that the Chancellor plans to raise £300 million primarily from those offering short-let accommodation to holiday makers via platforms such as Airbnb and Booking.com. This is part of a plan to help fund a 2p cut in the basic income tax rate.

“[Tax cuts] are my priority for the country. When it comes to this budget, I will only bring down taxes in a way that is responsible, and sustainable,” he said during a radio interview on Sunday.

Alarm

Both agents and landlords have flagged their alarm at the report, with NRLA’s Chief Executive Ben Beadle saying this morning that: “The Chancellor needs to address the chronic shortage of long-term rentals by attracting new landlords to the market.

“Squeezing holiday lets is not the answer. He should follow the advice of the Institute for Fiscal Studies and reverse punitive tax hikes which have stifled the supply of the homes renters desperately need.”

Extreme concern

Propertymark has also pitched in, with its CEO Nathan Emerson saying he is ‘extremely concerned’ to see reports of a rumoured £300m attack on landlords within the budget at a time when many have already left the sector and many more are just about holding on.

“Just like traditional homeowners, inflation and interest rates have hit landlords with force and there needs to be recognition from the UK Government that to provide high quality homes, whether they be short term lets or longer-term housing, the system must be workable,” he says.

“It is unacceptable that there is constant aim being taking at landlords to the point the viability of the entire system is becoming seriously questionable for both existing landlords and future investors.”

Personally I think about time! The “AirBnB” market genreally isn’t regulated in the same way and although in some areas you can only let “Airbnb” for 90 days days I don’t believe this is adhered too either.

We have a shortage of long term let’s available (for lots of reasons) and im aware of 5 “landlord” who only use there investment properties for short term let’s! So let’s make it more attractive for them to let on a minimum 6months AST basis.and help families get homes

And stronger belive this whole market and the Rent to Rent to Rent brigade should be regulated as much if not more than AST landlord… and yes 100% pay a hirer tax as a consequence

You are behind the times: the six month AST is being abolished in the Rental Ruination Bill so that all tenancies can be as short-term as any tenant wishes, or as long-term as they wish after they stop paying rent and string out the eviction process for months while it grinds through the still non-existent Housing Courts.

I can’t think of any tenant who would consider living in an AirBnB long-term, given that the average cost appears to be about £100-120 a night. The regulation is in the price levels: short lets are aimed at milking people seeking holiday accommodation, and the demand is clearly there. If you force short-term lets out of business, then surprise, surprise, everyone will be complaining there’s even more of a lack of affordable holiday accommodation, and that it’s cheaper for people to fly abroad instead, doing wonders for climate change.

If the Government or local councils want more landlords to offer long-term tenancies, they should make it more attractive for landlords, not box them into a corner with ever-increasing taxes and regulation from all directions! If you punish them for choosing holiday lets and if you punish them for choosing longer-term lets, then guess what? A large proportion will just leave the sector entirely. The Government should recognise that landlords are sick of the constant vilification and never-ending regulation and tax increases. Many are so demoralised, they will be delighted to take their money elsewhere when they get the opportunity, such as their last tenant moving out and the sales market looking healthier. Certainly the number of landlords seeking to buy new properties and increase their portfolios have collapsed in most parts of the country. The Government has created its own housing crisis by exclusively favouring tenants to the detriment of landlords, just as it has failed to enable a business environment that might achieve its own new-build housing targets.

Unfortunately all current indications are that Labour will be even worse. Landlords will of course be blamed for the fallout.