Agency boss promises to beat housing slump AGAIN after posting record results

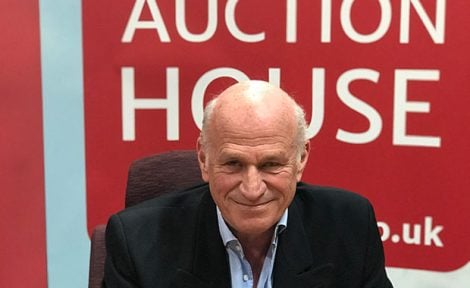

Gareth Samples says he is bullish about the future for his company's thousands of employees despite gloomy results from competitors.

The Property Franchise Group (TPFG) celebrated another record set of results yesterday – it’s sixth in a row – and boss Gareth Samples reckons they’re only going to get better despite difficulties within the housing market.

Samples (main picture) has been chief executive at the TPFG since April 2020 and told The Neg that the last year has probably been one of the most challenging for the Group.

“We’ve delivered record results for the last six and a half years but this one has been probably the most challenging,” he says.

“The market is not what it was in 2021 and 2022. The franchisees have been able to adjust and adapt and as to lettings activity there are just so many tenants looking for property.”

Housing

Lettings performance has more than offset a drop in sales for the first six months of the year. With 77,000 managed properties Management Service Fees increased 3% to £7.7 million helping to offset a small decline in its sales agreed pipeline to £28.4 million compared to £33.8 million this time last year.

It just shows how resilient the business is.”

“It just shows how resilient the business is,” Samples says. “I think the last two months since the end of the close period you have seen the pipeline convert at a better rate than it has than any month in the first six months.

“There was that wobble in May when we almost went back to the Liz Truss November scenario when suddenly Armageddon was back on the cards but then it seemed to go away in three weeks. There might be a little blip that might come through but any conversation has been much better so far and the lettings growth is continuing.”

LETTINGS GROWTH

And it’s that growth in lettings that Samples believes shows little sign of abating.

“There’s nothing that is going to stop the lettings market at the moment,” he says. “We’re getting 10 to 20 people for every property that comes up for rent and they just go really quickly but what that’s doing is driving rents up.”

Samples says the issue of rents continuing to rise is all about supply and demand.

Rents will continue to go up next year.”

“If you have more than 10 people wanting to rent a property that would suggest prices will have to continue going up because you only need one person to rent each property and one of those 10 may well be willing to pay over the odds or more money for that property,” he contends. “With the amount of demand that’s out there I struggle to see demand stabilising and rents will continue to go up next year.”

But he concedes: “We will hit a point when people can’t afford to pay more for their rent but we’re not there yet.”

DRIVE SALES

So how does Samples counter the surge in demand for rental property with the need to drive sales?

“It’s that balance between how far the lettings business is going to go forward and how far you can you control the sales market not to go back so much. We’re still waiting for that stabilisation of the market to see what 2024 is going to look like.”

There’s only so much people can afford.”

“Mortgage rates this time last year where significantly lower than what people are being asked to pay now – therefore demand will weaken. There’s only so much people can afford,” he says.

“There’ll be people sitting on their hands wondering what’s going to happen to interest rates. What we’re looking for is housing market stability and that is not quite there yet and not as many people will dip their toe.”

“We’ve already got the pipeline that will take us through to December so it’s about how far can we build that to get ready for the first half of next year – which seems mad!”

Madness it may be but with mortgage rates at the highest for over 15 years any attempt to boost housing market traction will surely be welcomed amongst TPFG’s franchisees.

UNIQUE CULTURE

TPFG covers nine brands including EweMove, Hunters, Martin & Co and Whitegates and Samples says that the Group identifies with them all and understands the unique culture of each and how to support them to expand within the housing market.

“Everything has been thrown at the business in the last three to four years and the franchisees have just come through it,” he says. “That’s the strength of having franchisees running one or two offices and being absolutely laser focussed for what they have to do to cover their costs and make a living. That’s where we differ from a lot of businesses within the sector.”

It’s lonely running your own business.”

“It’s lonely running your own business,” he adds. “What we offer is a group structure and cost savings through some of the products that we can pass on to the franchisees.

“We’re still highly inquisitive and if the right business came along we’d look at it – we don’t believe we’ve finished now and we certainly don’t believe that we’ve peaked.

“The TPFG model is resilient and robust and my view is that it’s the way to go for agents.”