Bangor, Port Talbot and Cheshunt

Each month we visit three agents across the country to discover what is happening in their local market. This month we meet members of The Guild of Property Professionals in Bangor, Port Talbot and Cheshunt.

NEATH, PORT TALBOT

Jonathan Morgan, Director

Jonathan Morgan, Director

Peter Morgan Sales & Lettings

Despite the pandemic and lockdowns, 2020 was a great year for our business with high levels of activity and our market share increasing from 11 per cent to 16 per cent.

Our local market has continued to suffer a shortage of available stock with several qualified buyers outweighing the number of sellers. In particular, we have seen an increase in house prices at almost a 10 per cent increase for properties under £125,000.

The current property market competition is being driven at the lower end by very competitive first-time buyers versus investors. With shortage of stock, we have seen investors struggle to buy properties on the open market for the prices they were accustomed to in 2018 and 2019. With the return of the first-time buyers being prepared to spend more money on a comparative property, we have seen investors scramble over the same deal therefore driving lower end property prices higher.

Slow upper end

On the other end of the scale, with the closure of Bridgend Ford and other high paying factory roles we have seen a slower upper end to the market. Opening in January 2021 there has been no sign of a slowdown and we are on track for a record January. Despite the global pandemic we are confident the South Wales housing market will continue to hold its value and still offer an ideal investment area for landlords and idyllic attractive place for first time buyers.

With COVID-19 restrictions in place in Wales, we at Peter Morgan have continued to work safely, efficiently, and effectively selling and lettings properties, and arranging finance for mortgages and health and life insurance for clients.

We achieved 103 per cent of asking price and 85 per cent of what we listed we sold.

Pictured property: Wrenwood, Neath, Neath Port Talbot

BANGOR, GWYNEDD

Melfyn Williams, Director

Melfyn Williams, Director

Williams & Goodwin

No doubt this year, more than ever, will be difficult to predict in the short term with the ongoing matter of the pandemic, any fall out from Brexit and of course the usual issues of affordability, supply and demand will all play a part in what happens.

According to the Nationwide, despite the pandemic, the average UK house price ended the year 7.3 per cent up on the previous year with our area statistics displaying around 5.4 per cent price growth. It may be that this surge in activity towards the end of the year was just catching up for the sales that did not or could not happen in the first lockdown back in the Spring.

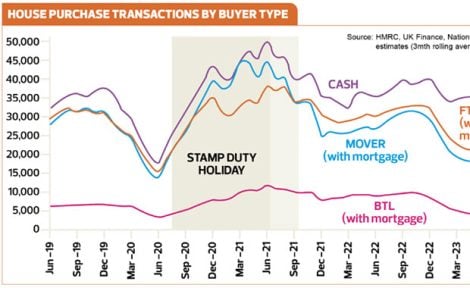

Whilst campaigners are calling for the Stamp Duty/LLT holiday to be extended or at least have a softer ending rather than the proposed ‘cliff edge’ stop date; the impact here in Wales is expected to be less than across the border. The pressure is now on for those to purchase before the deadline. Once this tinkering with the market has ended there may be a small pause in activity, however, we do believe the traditional spring market will continue.

Pandemic fallout

What is likely to have the greatest impact in the coming months in the property market will be employment and any redundancies which may appear as furlough schemes and other business support packages are finished.

People will always need a home, and this usually bodes well for the lettings sector. Demand has been strong in the last quarter of 2020 with average rents in our area increasing to over £700 for the first time (Circa £533 pcm a year ago). One must question if this is sustainable and if the sales market slows, more property may enter the lettings market which may then affect yields and rental levels.

In the interim period, virtual valuations and viewings backed up by knowledgeable teams of property professionals who know the local marketplace may well continue to be a popular safe choice for people who want or need to move quicker.

From the team here at Williams & Goodwin may we extend our best wishes for a safe, healthy and Happy New Year!

Pictured property: Bangor, Gwynedd – asking price £110,000

CHESHUNT, HERTS

Adam Sanders, Company Director

Adam Sanders, Company Director

Shepherds Property Sales and Lettings

Much like many of the agents featured in The Negotiator magazine last year, we experienced a sizeable influx of agreed sales and lets after the first lock down. This continued right the way up until Christmas with us agreeing three times as many sales and lets during December 2020 than we did during the same month the previous year. During December we managed to agree sales from £390,000 up to £1,000,000 – with the last sale being agreed on the 23rd December.

So far, January has been slightly more challenging. We have found that there are large numbers of applicants looking to move to the area, and fewer people looking to sell. Properties that are being put on to the market are generally achieving a large number of viewings and sell relatively quickly (due to lack of competition). This is the same on the rentals side; demand outweighs the supply by quite a margin.

Brexit knock-on

One of the challenges we face, ignoring the supply limitations and global pandemic, which likely go hand in hand, is the knock-on impacts of Brexit. Last year was the year of EWS1 forms, this year will be the year of the ILR document. We also have the pressures of pushing sales through before the Stamp Duty holiday deadline, which at the time of writing has not been extended.

With our sister brand being Fine & Country, we previously specialised in the higher mid-market threshold. This allowed us to assist our clients in making the jump up to the high-end homes we advertise as Fine & Country. However, over the last eighteen months we have been gaining an ever-increasing market share of properties selling between £350,000 to £450,000 – which translates in local terms, averagely, to three-bedroom semis and terraced homes.

The rentals market, and subsequently our portfolio, is currently dominated by two-bedroom apartments and three-bedroom homes, positioned within walking distance to train stations with access into London.

Pictured property: Roydon – three-bedroom, semi-detached home, sold recently for £525,000

Send us your own Regional Report!

We'd like you to contribute your own Regional Report for publication too.

Just click the button below and follow the prompts to share your local experience with our national audience of estate agents.

Have ready a head and shoulders picture of yourself, plus a property picture of a current interesting property you have for sale.