first-time buyers

-

Housing Market

Average FTB mortgage payments up 61% since 2019

First-time buyers are shelling out over £1,000 a month in mortgage payments – more two thirds the amount since the last General Election, data from Rightmove reveals.

Read More » -

Associations & Bodies

High house prices and deposits still ‘too high’ say buyers

The Building Societies Association warns that more than half of people think the deposit required to buy a home is too high and first-time buyers are struggling.

Read More » -

Kate Faulkner

KATE’S VIEW: ‘High rents are helping fuel first-time buyer activity’

Kate Faulkner says there is hope for first-time-buyers and with the help of Nationwide and Hamptons, has the statistics to prove it.

Read More » -

Housing Market

First-time buyers paying 191% more than parents did in 1990s

My Home Move Conveyancing Director, Alistair Singer, says average earnings-to-house-price ratio has more than doubled from 4.0 to 8.1 adding more pressure than ever on those looking to start their home-owning journey.

Read More » -

Housing Market

Estate agents, your next first time buyer could be over 50!

Earlier this week, new data from the Bank of England revealed that the last quarter of 2021 nearly a third of mortgages had an end date beyond the state pension age.

Read More » -

Latest property news

Subsidising weddings could help first-time buyers secure their first property

The Centre for Social Justice has called on the Government to discount the administrative, legal and booking fees of weddings for first-time married couples – saving on average £550 per couple.

Read More » -

Housing Market

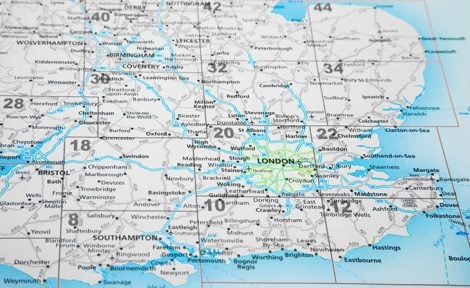

Huge North-South mortgage divide revealed among first time buyers

The state of the economy, mortgage availability, upfront costs and varying house prices across the UK are impacting affordability and financing options for first-time buyers.

Read More » -

Housing Market

Smaller homes’ prices rise as first-time buyers compete

Smaller homes have recorded the strongest increases as first-time buyers battle higher mortgage costs and the cost-of-living, accounting for 53% of all homes bought with a mortgage in 2023 – the highest proportion since 1995.

Read More » -

Regulation & Law

FTBs facing huge affordability squeeze – but will Tories help?

Zoopla’s Richard Donnell says long-term fixed-rate mortgages could help first-time buyers but this is a cohort that needs Government support.

Read More » -

Housing Market

Building societies calls for looser mortgage regulation to fix ‘broken housing market’

Successful first-time buyers rely on Bank of Mum & Dad and have two above-average incomes, leaving those without help, or single, stuck in the rented sector.

Read More »