KATE’S VIEW: ‘High rents are helping fuel first-time buyer activity’

Kate Faulkner OBE tells The Neg there is hope for first-time-buyer house hunters and with the help of Nationwide and Hamptons, she has the statistics to prove it.

Their data shows that “the monthly cost difference between buying and renting appears to have returned back in favour of buying”.

So much so that in “February, the average first-time buyer would find themselves £136 better off every month by purchasing a home with a 10% deposit than renting. This is despite the average mortgage rate on a 2-year fixed 90% LTV loan remaining above 5%.”

As a result, the agency’s data is showing that first-time buyers “have made up a record 33% of all buyers so far this year, up from 23% pre-pandemic.” And are a key market to appeal to this year, despite the current high mortgage rates.

Now these are based on averages and only agents and brokers can help FTBs to truly assess which is better financially for them on an individual basis, in their local area. And of course, there is a much greater initial cost to buying than renting – especially with the requirement for a deposit.

According to Nationwide, there is still room for more FTBs to get on the ladder.”

Despite the high proportion of FTBs that Hamptons are recording, according to Nationwide, there is still room for more FTBs to get on the ladder. Their latest index shows that “Recent research carried out by Censuswide on behalf of Nationwide found that nearly half (49%) of prospective first-time buyers (those looking to buy in the next five years) have delayed their plans over the past year” and the reasons that FTBs are giving are shown in the graph below:

And the good news is that FTBs will compromise – probably more so than those who are already on the ladder looking to move up or down.

Setting sights lower

According to further research, buying something smaller, including a flat is something they are happy to do as well as look further afield, no doubt something that has been influenced by the pandemic:

Sell on deposits and income

So, could more first time buyers get on the ladder in your area? What’s the comparison between buying and renting – does it make financial sense? And, rather than talk about what deposits are ‘needed’ according to averages and national or regional indices, how about selling properties based on what the minimum deposit and income required would be?

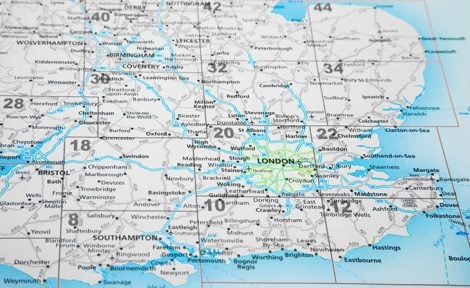

It may not work in some of the more expensive areas, but in more affordable areas, I am convinced that given the right information and local comparisons, there are many more people we could get on the ladder than are currently even thinking of looking.

Read more opinion columns by Kate.