Local knowledge – how property market data wins business

Media headlines such as, “Hopes that the property market has a spring in its step” or “Housing market worst for 20 years” may capture eyeballs, says Kate Faulkner, but successful agents use the data behind the headlines to win business.

Unfortunately, especially since the credit crunch, property prices and rents are not moving consistently ‘on average’ as they have done in the past. It’s individual property prices and rents that consumers really need to understand to properly make their property decisions.

Add to this the issue of agents not always being the most trusted people in the homemoving process, when the media headlines ‘explain’ what’s happening in the property market, consumers tend to believe them – not necessarily the agent – despite the fact that agents are in the best position to give people the most up to date ‘picture’. This can lead consumers to choose the wrong agent to work with, i.e. the one telling them ‘what they want to hear’ as opposed to the one explaining that the market isn’t so buoyant at the moment and prices/rents need to be set at a fair rate to attract viewings.

So how do agents and other property companies ‘take back control’ to explain to local people what’s actually happening in the local area? And, will this help to improve much needed transactions?

CASE STUDIES

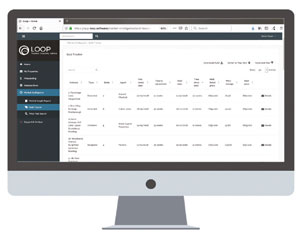

Local market data doesn’t have to take long to produce as some agent software can help to create the reports for you. Claire Owen from Loop Software says, “We work with price paid data which, when combined with marketing data, provides a really interesting and transparent overview of the local market.”

We know from working with this data that ‘averages’ can be misleading, especially in more rural areas where properties are less likely to have direct comparables. From Claire’s perspective, “The key is in being able to analyse not just the locality of the property, but the property type and attributes which will give a much more accurate impression of the real market movements.”

One feature is the ‘Sold Tracker’ data that shows agents the first listed price of a property versus the final selling price and the difference – giving great data to show potential consumers and secure their trust that you are the right company to work with.

One feature is the ‘Sold Tracker’ data that shows agents the first listed price of a property versus the final selling price and the difference – giving great data to show potential consumers and secure their trust that you are the right company to work with.

And for some, local property market data can be a better way to engage with people via newsletters and social media. For those that really want to engage with consumers now and in the future, regular local seminars for buyers, sellers and investors can gain significant popularity. For example, I’ve been presenting with Maxine Lester for eight years and at the most recent event we had over 100 landlords in the room in Huntingdon.

Awareness Interest Desire Action

One of the key concepts used by marketers to capture consumers is the ‘AIDA model’. This explains the stages people go through to decide on how to buy a product or service.

Whether you are an agent, developer, legal company, a surveyor or anyone else involved in helping people carry out a property project, one way to start the process of capturing consumers is to follow the AIDA model. For those who do, there is a huge bonus. One of the things people love to know about is what’s happening in the property market, which is why the media cover it every day. Gaining awareness and interest of your business by providing quality local market data that monthly price and rental indices can’t do, can be a great way to ensure you are the first agency that consumers call when buying, selling, investing or renting.

Unfortunately, in my experience, this is where many property companies go wrong. In the car, food, health and beauty business a lot of money is invested marketing to people before they buy, while in our industry, most companies only engage with people when they already have a ‘desire’ or want to take ‘action’.

Sadly, in property, I think that point is usually the worst time to try to promote a property company’s services as people who are moving tend to be highly stressed because they are:

- Having a baby

- Getting divorced

- In debt

- Someone has died

- They are planning a wedding

As a result they tend to focus on the wrong things, such as whether you are the cheapest as opposed to whether you are going to give them the best service and if you telling them what they want to hear ie the market is ‘great’ just to secure instructions as opposed to the ‘market is not so good just now, this is what we will need to do to secure a sale in the current market’

This is why local property market data is a gift to agents, developers, legal companies and surveyors. Most people –whether intending to buy, sell or let, are genuinely interested to know ‘what is really happening’.

If you are able to establish your company as the main provider of quality and accurate market trends, this can be an extremely cost effective way of raising ‘awareness’, gaining their ‘interest’, ensuring when someone is ready to make a decision and take action, then you are the most likely person or company they will contact first.

CASE STUDY

Landmark

Ben Robinson, Director of Agency Services, Landmark Information, says, “There are plenty of case studies to back up the success of local agent growth through local property market data. New agents such as Purplebricks and YOPA have effectively used local market data to build relationships with home-movers and gain their trust by delivering valuable and interesting content”.

Ben Robinson, Director of Agency Services, Landmark Information, says, “There are plenty of case studies to back up the success of local agent growth through local property market data. New agents such as Purplebricks and YOPA have effectively used local market data to build relationships with home-movers and gain their trust by delivering valuable and interesting content”.

To David, it’s essential for agents to deliver “regular postcode specific updates, moving trends and price variations, all of which endorse credentials that the agent is the local property expert.”

LANDMARK’S TOP DO’S AND DON’TS

Do’s

- Make it about your consumers

- Keep the content light and engaging

- Provide a visual stimulus via pictures/diagrams

- Become THE local property expert

Don’ts

- Make it about you!

- Waffle

- Forget to keep in touch with home movers – continue to provide regular market updates and keep them engaged to generate recommendations.

- Send too much information too often.

CASE STUDY

Maxine Lester

A Gold Award winner at The Negotiator Awards 2018, Maxine Lester, is a slightly unusual agency in that they already publish their own statistics on their local area and their own performance, see more here…

A Gold Award winner at The Negotiator Awards 2018, Maxine Lester, is a slightly unusual agency in that they already publish their own statistics on their local area and their own performance, see more here…

The seminar built on this transparency with a presentation on the politics and economic issues affecting the property market now and in the future – and it specifically focused on the local market in Huntingdon and surrounding area.

In addition, Maxine presented on what was happening with local demand and supply and what landlords needed to do to attract the different tenant types in the Huntingdon market.

Finally there were presentations on the importance of tax and the latest on mortgages and financial planning.

To maximise the promotion of the seminar and build more marketing for future seminars, the presentation and a bespoke interview with Maxine, it was recorded by Property Tribes and promoted on their forum. This means the opportunity of reaching a total subscriber base across all their channels and data lists of over 90,000 landlords.

Creating local market data

There are some excellent examples of companies that do this, such as Savills quarterly Property Residential Focus report which comes as a PDF, via a video and also provides forecasts for prices and rents in the future: https://www.savills.co.uk/blog/article/273877/residential-property/residential-outlook-six-trends-for-2019. aspx. LSL produce their own market intelligence reports, which include monitoring prices and rents as well as one off annual reports, such as their Tenant Survey 2018 under their Prism brand. http://www.prism.co.uk/wp-content/uploads/2018/06/PRSim-LSL-Tenant- Survey-2018.pdf.

Savills and LSL, of course, have the structure to create wide ranging reporting, but smaller agencies can also produce really strong data and reporting by using specialist companies such as Dataloft https://informpropertyanalysis.com/#services. They provide local property analysis and create branded and personalised reports especially for you, to use in your marketing, in blogs, brochures and on your website. These reports can make the critical difference between sounding vague and having an informed conversation with clients about your market.

In most businesses, people engage with their marketing before they buy. In property, most agencies only engage with people when they actually want to take action.

You don’t have to comb through the reports yourself; companies such as Dataloft, will do the legwork for you. Dataloft won the Gold Award at the Negotiator Awards 2018 for Services & Products (Marketing), a well-deserved recognition for their product, Dataloftinform. This is an online tool, available on subscription, which offers all the detail you need, but presented in smart, branded reports featuring infographics which agents can use in their own presentations to clients – plus charts, graphics statistics, specific to a postcode you choose.

I have worked with Belvoir for over a decade to produce their in-depth rental index, where we focus on local owners feedback https://www.belvoir.co.uk/pages/rental-index. There are several ways you can support your view of the market.

Michelle Meah at Property Network says, “We’ve seen at first hand the demand for local market data from the agent’s perspective as well as the public, as a result of Virtual Val – our instant valuation tool. People love how they can find information at their fingertips – it is now essential for agents to offer a digital solution for homeowners who want to find out how much their property is worth.

An instant valuation tool not only satisfies the user’s curiosity but in return for their personal details, it gives agents hot leads to prospective homeowners potentially planning to market their property.”

“However, it’s absolutely paramount that you offer accurate intel when quoting facts and figures. The benefit of discussing market activity is that you are able to demonstrate your knowledge and understanding – giving you credibility when it comes to knowing your industry. It’s a window of opportunity to engage with a targeted audience you haven’t reached before.”

Michelle also has a tool for agents to know their market – Agent Canvassing, which can gather intel on new instructions, reductions, withdrawals, a vendor due out of contract, etc. allowing an agent to compete for business at a crucial time.

What do people want to know?

I present the ‘averages’ that people read in the media eg the Land Registry data as this helps gain their trust. This is already in The Negotiator and on: www.propertychecklists. co.uk. I present case studies of properties performing at different levels versus the ‘average’. An average price (or rental) growth might be announced as eight per cent in the media for the region year on year, but this is made up of a fall in new build flat prices, two bed properties increasing by five per cent and smart, executive four-bed houses up by 15 per cent each year. I then compare this data to the last ‘height’ in the market. Prices might be going up in Northern Ireland, but after 58 per cent falls during the credit crunch, some properties will still be worth a lot less then people paid.

This data really helps to increase trust and help people to understand what’s happening to the price of their property.

More interesting data:

- How long properties are on the market

- Whether first time buyers are active or last time buyers are key in the local market

- If properties are selling or renting near to or over the marketing price

- What properties are in high demand, what are oversupplied?

- If renting, how long the local void periods might be

- Are more properties or less selling/ renting this year versus last

- Should people do properties up to sell or can they get a good price for a wreck?

- Are there any particular areas which could be considered a ‘hot spot’ e.g. new transport links

- Where are the most affordable areas to buy/rent?

- If a property isn’t selling what can you do to secure a buyer?

If clients that are happy to appear as case studies, they are very popular. The main thing communicating your knowledge and creating your position as the ‘go-to’ agency in your area.

CASE STUDY

Richard Donnell, Zoopla

Richard has been producing some fantastic information over the years – much of which has been published in The Negotiator and that I have often used!

Richard has been producing some fantastic information over the years – much of which has been published in The Negotiator and that I have often used!

Richard points out the “main thing to highlight is that consumers want localised data as they think locally.”

The latest Zoopla State of the Property Nation report shows that 31 per cent of people know the house or street they want to live in next – even more for those looking to move in their ‘neighbourhood’.

Forty-five per cent of people said they were “browsing”, while 28 per cent were “actively looking” to buy/sell/rent, so demand for information and analysis on the local market is essential.